A fairer tax system is essential to ‘building back better’

This article originally appeared in Oxfam's 'Views & Voices' blog on December 16th, authored by Robert Palmer, Executive Director, Tax Justice UK.

Tax Justice UK shares Oxfam’s commitment to tackling inequality, eradicating poverty and standing up for those who typically struggle to get their voices heard. The need to address these issues has only become more urgent in light of the covid-19 pandemic, which in the UK as elsewhere has had a disproportionate impact on the most vulnerable in society, including ethnic minorities and those in low-paid and insecure work.

As news of vaccine breakthroughs finally put an end to the crisis in sight, it would be easy and tempting to revert to the status quo. But recovery from the pandemic provides us with a rare opportunity to place society on a more equitable foundation, including a fairer system of taxation.

Prior to the crisis, the UK’s tax system – unfair, poorly-understood and ineffective – was already in dire need of reform. But with the government signalling that it intends to increase taxes in the coming years, now is the time to undertake reform so that tax rises do not aggravate the failures of the current system.

One of Tax Justice UK’s key priorities is campaigning for greater taxation of wealth. In the UK, wealth is undertaxed in comparison to income, exacerbating a highly unequal distribution of wealth in which just 10% of households own 40% of all household wealth. Taxing wealth more effectively would not only reduce this inequality but provide additional public funding for our increasingly stretched schools, hospitals, social care and the many other public services people rely on.

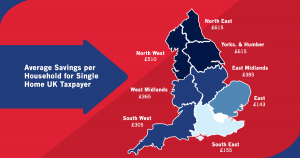

Our manifesto for tax equality, in which we set out the case for greater taxation of wealth, identifies council tax and stamp duty as particularly problematic and ripe for reform. By taxing people living in lower-value housing more – as a proportion of property value – than people living in multi-million-pound mansions, council tax is a deeply regressive tax that unfairly benefits the UK’s wealthiest individuals and regions. Stamp duty, while more progressive, makes it unnecessarily costly to downsize or move home, creating economic inefficiencies. The manifesto calls for a proportional property tax to replace both taxes, which unlike council tax would tax homeowners consistently based on a fixed percentage of property value.

Despite a growing consensus among experts and across the partisan divide that council tax is unfit for purpose, the ever-growing arguments and evidence in favour of its abolition have so far struggled to cut through. That is why Fairer Share, a new grassroots campaign to replace council tax with a proportional property tax, is so important. By setting out the problems with council tax in an accessible and intuitive way and putting forward a detailed and fully costed alternative, Fairer Share is making a valuable contribution to the UK’s burgeoning movement for progressive tax reform.

That’s why earlier this year Tax Justice UK was delighted to sign an open letter to the Chancellor, coordinated by Fairer Share and supported by organisations across the political spectrum including the Institute for Public Policy Research (IPPR) and Demos calling for property tax reform. The letter urged the government to “conduct a thorough review of Britain’s residential property taxes” and replace council tax and stamp duty with a fairer system, based on property value and ability to pay.

Since the poll tax riots in 1990, which directly led to the introduction of council tax, successive governments have tried their best to avoid the topic of property tax reform. This is partly due to understandable concerns about the complexity of the task, and partly due to less noble fears of alienating donors and wealthy homeowners in key constituencies.

Yet in recent years a growing body of research and analysis has gone a long way in resolving many of the objections associated with council tax reform. And when it comes to public opinion, politicians have less to fear than they might think. Polling conducted by Fairer Share shows that just 29% of the public believe that the way council tax is calculated is fair, while only 33% favour keeping it unchanged. Meanwhile, recent research by Tax Justice UK shows that a majority of people want to see wealth taxed more, including 64% of Conservative voters and 88% of Labour voters, with 67% in favour of tying property tax more closely to a home’s current value.

Once the covid-19 crisis subsides, the government will attempt to meet its ambitions of “building back better” and “levelling up”. Tax reform, including replacing council tax, must be part of that agenda. Tax Justice UK looks forward to working alongside Fairer Share and other like-minded organisations in the coming months and years to ensure that is the case.

LISTEN | Conservative MP explains why Council Tax must be replaced

After the launch of the Conservative's Property Research Group, the following interview took place with its Chair, Kevin Hollinrake MP, on talkRADIO on 11/12/2021.

At Fairer Share, we look forward to presenting our solution for The Proportional Property Tax to the Property Research Group in the coming months.

00:50 - Introducing Kevin Hollinrake MP.

01:07 - The problem with Council Tax.

01:35 - Why this call for reform is very different to the Poll Tax.

02:35 - How Stamp Duty harms the economy.

03:48 - What is the aim of the Property Research Group?

05:10 - END

Kevin Hollinrake MP | I'm launching the Property Research Group of MPs to fight for reform of outdated property taxes

The article by Kevin Hollinrake, MP for Thirsk and Malton, first appeared in the Daily Telegraph on 11/12/2020. For the original article, please click here.

The current system is quite simply not fit for purpose. Take council tax. Every household in England – renters and owners alike – pays this annual fee to help fund important local services, from rubbish collection to maintaining parks and public libraries. No-one disputes the purpose of the tax. Yet, according to new polling out today, council tax is the most unpopular tax in the country.

This is largely because the amount of council tax households pay does not in any way reflect the current price of their home. The tax is calculated on a system set up in 1991, nearly 30 years ago. This outdated tax therefore has a disproportionately higher impact on younger and poorer people who tend to live in low value homes. A person living in a property worth £100,000 may pay six times as much tax, as a proportion of their home’s value, compared to someone living in a £1 million property.

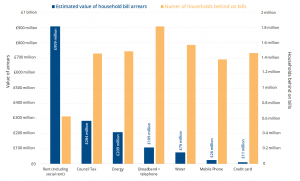

Many low-income households who cannot afford to pay are aggressively pursued by local council and debt collection agencies. According to Citizens Advice, 40 per cent of problem debt can be apportioned to council tax. Covid-19 has only made the problem worse with an extra £700 million in council tax debt accrued by 800,000 struggling households since March. The inability of people to pay council tax is contributing to the perilous state of local government finances. According to statistics published by the Ministry for Housing, Communities and Local Government, households in England collectively owed more than £3.5 billion in council tax. Over the past five years there has been over a 30 per cent increase in overall council tax debt.

Stamp duty is another property tax which is an attack on aspiration and ownership. By taxing property transactions, stamp duty discourages homeowners from moving – be it an older couple downsizing or a growing family upsizing – that would lead to more efficient use of the country’s housing stock. Figures published earlier this year by the campaign group, Homes for Later Living, show that over 3 million people over 65 would like to move home but don’t feel they are able to. The fall in transactions ultimately results in fewer new homes being built because market signals, to which housebuilders respond, are distorted.

My friend, the Chancellor, has implicitly acknowledged the economic harm inflicted by stamp duty by cutting the tax where it is seen to be most burdensome. In addition to the tax-free threshold for first-time buyers, in response to the downturn caused by the pandemic Rishi Sunak announced the exemption from stamp duty of all residential property transactions worth up to £500,000 until April 2021. Given the ongoing impact of Covid-19 on the economy and the long recovery that is likely to follow, returning stamp duty to its pre-crisis levels next April would be an unnecessary and unaffordable act of political and economic self-harm.

Business rates is yet another property tax which hampers investment. It is one of the biggest contributors to the death of high streets up and down the UK. And it has an impact on some of those places most in need of levelling up. Seventy-five per cent of constituencies with the highest rates burden are located in the North and the Midlands. This is because the tax rate does not mirror economic performance, so for areas facing economic challenges the burden is much higher. The Government has recognised this and taken bold action by publishing a fundamental review of business rates and providing a business rates holiday for retail, hospitality and leisure during the Covid pandemic. This has been welcome but long-term and sustainable reform is vital.

Council tax, stamp duty and business rates are just three examples of an out-of-date system which is in desperate need of reform. This is why I am forming the Property Research Group. Together with colleagues from right across the country, we will be putting forward proposals to design a fairer and more efficient property tax system that works for all.

Kevin Hollinrake MP is Chair of the Property Research Group.

Supporter letter | There are systemic failings with Council Tax

One of our supporters, John, has shared his personal experience fighting against the unfair Council Tax system in Northumberland. He supports Fairer Share because he agrees that we need one simple, fairer tax system.

Dear Fairer Share,

My complaint is not just about the level of Council Tax bills, but also about the way councils arbitrarily make decisions and enforce them, employing automated processes that end up with debt collectors.

My first experience of Council Tax was when my late aunt—who was elderly and suffering from dementia—had her Council Tax discount benefit wrongly cut off.

Unfortunately, similar methods were also employed on me, despite being a pensioner on an income level that should qualify me for a Council Tax discount and housing benefits. I had helped my aunt buy her house on the basis that it would come to me after her death. When she died, it took us 7 months to sort out her affairs and carry out essential work to the house, so it could be brought up to the required standards and be lived in safely.

The council however, acted immediately to disqualify my Council Tax discount and housing benefits from the date the property title was passed to me. Its capital value was used to disqualify my entitlement even though it was a liability not an asset. The council made me pay the full Council Tax on the inherited house as well as the rented property I was previously staying in nearby. I was also made to repay “overpaid” housing benefits. The council and the Valuation Office both rejected my argument that paying two sets of Council Tax, plus paying back housing benefit constituted severe hardship.

My income as a single pensioner was reduced to far below the sum the government specified for pensioners to live on, ironically the same formula used to determine benefits in the first place. At the same time as they refused to alleviate the hardship they had caused, the council were giving out exemptions to private landlords for carrying out the same kind of essential repairs that I had to.

I was not only concerned about the money and hardship, but also the way the council behaved throughout.

I was pleased to come across your campaign as the current system needs to be simplified. I do wonder how many there are out there paying too much and not having fair assessments or appeals, especially with millions of homes going into debt since the start of the pandemic. There seems to be major systemic failures.

John L

Northumberland

Join John, sign and share our petition for a fairer system.

WATCH: Treasury Committee | Tax after Coronavirus

The House of Commons Treasury Committee held an oral evidence session on November 18th for its Tax after Coronavirus inquiry. Reforming Britain's property taxes was one point of discussion. Watch what Robert Palmer of Tax Justice UK and Arun Advani, Professor of Economics at the University of Warwick, had to say:

Robert Palmer (Tax Justice UK)

Arun Advani, Assistant Professor, Department of Economics, University of Warwick

We look forward to seeing the Treasury Committee's recommendations for dealing with Britain's property taxes after Coronavirus. The evidence heard in this session, in addition to the written evidence we submitted should emphasise how important reform could be.

Lockdown 2 | Replace Council Tax or watch debts spiral

We’re back in lockdown. Not the outcome that anyone was hoping for, but it is where we are and collectively, we have to make the best of it. Increases in Britain’s inequality and poverty levels have been sent into overdrive since the pandemic began, risking a national household debt crisis. Replacing Council Tax with a fair and equitable system must be high on the Government’s list of priorities over the winter…

Britain, we have a problem

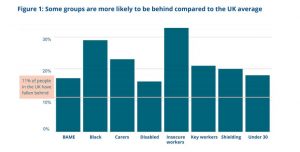

Citizens Advice estimate that over 6 million homes have fallen into debt on at least one of their household bills since the outbreak of Covid-19. A whopping 2.8 million of these homes are in arrears on their Council Tax payments. Of those in debt, 18% have been unable to afford essential items such as food, 30% have run down their savings in order to make ends meet, and 22% are having to sell possessions.

Key workers are feeling the squeeze

It is especially concerning that 21% of key workers have fallen behind on their bills compared to 11% of the general population.

Source: Citizens Advice (2020)

Source: Citizens Advice (2020)

Of those who have seen a reduction in their income during the pandemic, almost half (46%) have then fallen into debt. If this trend continues through the winter, the damage felt won’t just be to households across the country. Local businesses, local authority finances and our communities themselves will also suffer.

A roadmap to recovery

Council Tax debt isn’t just a short-term problem. With monthly bills continually charged, even to those in debt, the question becomes: how do you get out of it? 40% of those who speak to Citizens Advice currently have a negative budget. This means that after their regular monthly living expenditures, they have nothing left over. The average negative budget is £133. Furthermore, the average monthly surplus was only £82. This is all that is left over for debt repayments each month.

For millions of households, the recovery from the financial shock of the first wave of Covid-19 will be a long one. It is estimated that if those in debt spent their entire disposable income solely on their debt repayments, it would take over two years to repay their “priority” debts - debts that carry the most serious consequences if left unpaid.

Lockdown 2: We can turn this around

The figures above are from the first national lockdown — March to May. Now that we find ourselves plunged into a second iteration of lockdown, these figures are likely to get a whole lot worse. Not only will millions more homes be plunged into Council Tax debt, but those already in arrears will see their debt mount even further. But it doesn’t have to be this way...

A fairer solution

At Fairer Share, our sole aim is to fix the UK’s unfair property tax system. This means replacing the broken Council Tax with what we are calling: The Proportional Property Tax - a flat rate of 0.48% charged on the value of a property.

Of the major debts listed above, Council Tax is by far the simplest to reduce. Operated entirely by public institutions and with no private sector to consider, replacing Council Tax would be far easier than reducing rent or energy debts.

Not only does our proposal reduce tax bills for 18 million households, it also helps those most in need. Of the top 5 most income-deprived areas of the country, the average household saving under our plan ranges from £533 to £819 each year. This won’t suddenly fix the UK's household debt problem, but it will help to keep millions of families out of Council Tax debt and able to afford essential items such as food.

Furthermore, our proposal includes a deferral mechanism for those unable to pay. The 2.8 million households who have entered into Council Tax arrears since March won’t have to pay it back until they can afford it, or until the sale of their house.

Council Tax will no longer be a priority debt for those unable to pay. Not only will this greatly reduce the stresses of a potential bailiff visit, it allows households already in debt to start paying back their other important debts.

This deferral mechanism relies on removing 8 million renters from the property tax system. Renters have been one of the groups hardest hit by the pandemic, with many living paycheck-to-paycheck and over 320,000 are already in debt to their landlords. They need our support urgently.

We can help reduce the debt crisis, but we need your help!

You can support our campaign by joining the almost 70,000 households who have signed our petition for a fairer system.

You can also Email your MP to let them know why we need to replace Council Tax so urgently.

OECD report calls for a Proportional Property Tax in the UK

Earlier this month, The Organisation for Economic Co-operation (OECD) released its 2020 Economic Survey for the UK - a periodic review of the economies of its member states. The 2020 review covered areas ranging from productivity to trade, in addition to an impact assessment of Covid-19 and Brexit on the UK economy.

Encouragingly, the OECD also included a specific recommendation to reform Council Tax with a Proportional Property Tax - here is what they had to say:

"Council Tax could be increased to raise tax on high housing wealth. At the moment, the tax is charged at a much lower percentage of property value for high-value properties than for low-value properties. As recommended by the Mirrlees Review (2011), it would be simpler and more efficient to use a simple percentage of property value.

At the same time, this could be an opportunity to rebalance property taxes, moving away from stamp duties and transaction taxes. This would boost labour force mobility and encourage more efficient use of the housing stock. As Council Tax is local, resources could be used either to reduce the grant provided by the central Government to local authorities, or alternatively to finance services at the local level that have been cut recently."

The OECD joins an ever-growing list of organisations advocating for the UK to adopt a Proportional Property Tax, including the IFS, IEA, Adam Smith Institute, IPPR, and Resolution Foundation, many of whom signed our open letter to the Chancellor calling for reform to the UK's property taxes.

With the UK now firmly in recession and Coronavirus restrictions increasing, the case for a Proportional Property Tax has never been stronger. We hope the Government will listen to mounting calls for a new approach to property tax which is fair, simple and promotes aspiration.

You can read the full OECD report here.

You can read our Proportional Property Tax proposal here.

PODCAST | The Real Agenda: Lost Property (Tax) with Fairer Share's Andrew Dixon

Lost Property (Tax) with Andrew Dixon

Our founder, Andrew Dixon, joins Tom Burgess of the Coalition for Economic Justice, on his The Real Agenda podcast to discuss how The Proportional Property Tax would be fairer than the current system of Council Tax and Stamp Duty (listen below):

02:40 - Introduction

07:50 - What is the problem with our property taxes?

08:55 - What does Council Tax pay for?

09:40 - Why is Council Tax unfair?

10:50 - What is Fairer Share proposing?

11:20 - Who pays and why?

14:55 - Why not just change the Council Tax bands?

17:20 - How are we going to make this change?

18:50 - Why do we need to remove Stamp Duty?

21:00 - How can I join Fairer Share to make change happen?

Apple

https://podcasts.apple.com/gb/podcast/the-real-agenda/id1437103761.

Spotify

https://open.spotify.com/show/2AcLAWEad5Qak0ST6gUS4l

Amazon

https://music.amazon.co.uk/podcasts/9259fe21-5d3d-4c22-82b0-bac44316de3c/The-Real-Agenda-Network

Player FM

https://player.fm/series/2464307

https://podcasts.google.com/feed/aHR0cHM6Ly9yZWFsYWdlbmRhLmxpYnN5bi5jb20vcnNz

To sign our petition for a fairer system, please click here

12 things you didn’t know about Council Tax

We all pay Council Tax. But just how much do we really know about one of our largest monthly expenses? Let’s find out! We have compiled 12 things you might not know...

#1 - A house worth £100,000 pays 6 times more relative to its value than a £1 million property

This is like paying 6 times the VAT on a Ford Focus than on a Ferrari...

#2 - Some households would pay the FULL VALUE of their property in Council Tax payments in just 20 years

Have to read that twice? So did we! Certain properties in Easington Colliery, County Durham, pay up to 5% of their value each year in Council Tax. After just 20 years of Council Tax payments, these households will have spent the same amount on Council Tax as their house value!

In comparison, if you're lucky enough to own a £10 million property in Westminster, it would take 6,410 years of Council Tax payments to match your property value, and those living in more expensive homes it takes even longer! It’s just not right.

#3 - 3.5 million households are estimated to be in Council Tax arrears

Even before the pandemic, around 2.1 million households were in Council Tax debt. Between March and May, an estimated 1.3 million additional households had fallen behind on Council Tax, bringing the total to an outrageous 3.5 million British homes in Council Tax debt. This is not sustainable.

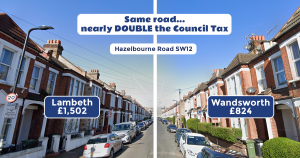

#4 - Houses on one side of the same road can pay £500 more than those on the other side

Our favourite fact. Nothing quite demonstrates how nonsensical Council Tax can be quite like a row of houses in Lambeth paying over £500 every year more than properties on the other side of the same street in Wandsworth. These properties really should be paying exactly the same or at least something similar. It’s just not fair.

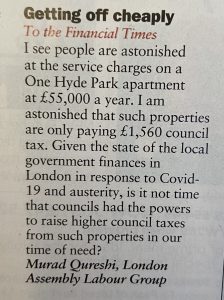

#5 - The richest are not always paying their fair share

We regularly see articles of billionaires moving their money to Monaco, Bermuda or the Cayman Islands to avoid paying income or corporation tax.

On top of this, tax bands do not reflect the value of mansions. As a result, we see £150 million properties in Kensington like this where the Council Tax is effectively capped under £2,474 per year.

We should all pay our fair share and property taxes should not be avoided by using clever loopholes.

#6 -Second homes, empty homes, and holiday homes receive exemption

Second homes and empty homes are eligible for a discount of up to 50% on their Council Tax bill. The Daily Telegraph even ran an article last year titled “How to pay no Council Tax on your second home”.

#7 - Areas with the cheapest Council Tax often receive the most in public funding

Often the regions with the cheapest Council Tax receive greater public funding than others. While many areas of London are amongst the cheapest for Council Tax despite high-value housing, more has been spent on funding London’s Crossrail between 2016-2021 (£4.6 billion), than has been spent on all transport projects in all of the North of England (£4.3 billion).

For three decades, properties in London and the South East have benefitted from this unfair system. These regional imbalances must be addressed.

#8 - Council Tax bands haven’t been updated for 30 years

In that time, average property prices in London have risen from £76,000 to £490,000, while prices in the North East have only risen from £42,000 to £132,000. As a result, the top four cheapest areas for Council Tax are Westminster, Wandsworth, the City of London, and Hammersmith. The more house prices rise in a region, the more out of date Council Tax bands become.

Wales did manage to update their bands in 2005, showing it is possible to analyse valuations with political will.

#9 - It’s complicated

Over half the population (52%) said they had no understanding of how Council Tax works. The system should be easy to understand.

#10 - Less than 30% of the public think Council Tax is fair and 67% believe it should have more of a link to actual property value

Our research found that less than 30% of the British public think the tax is charged fairly across the country. Tax Justice UK also found that 67% of the public (including a majority of Conservative voters) support reforming Council Tax so it was more closely tied to the property's value.

#11 - Council Tax has come to resemble to the dreaded Poll Tax

When the Poll Tax was introduced, the average bill per individual in today’s money was around £790. If we assume two adults per household this would mean £1,580 per household. In 2020, the average band D property now pays more than that in Council Tax - £1,820

#12 - Over 110,000 households have now signed the Fairer Share petition calling on Council Tax to be replaced with a fairer system

We live in critical times: income inequality in Britain is at its worst for a decade, regional inequality is out of control, and millions of people are left using food banks just to get by. Across the UK, there are now more food banks than there are McDonald's! On top of that, with Covid-19 leading the UK into recession and more families across the country struggling to get by, there has never been a better time to reform our outdated system of Council Tax.

So far, over 110,000 households have signed the Fairer Share petition to replace Council Tax and Stamp Duty with The Proportional Property Tax, a flat rate of 0.48% on the value of property. This would reduce annual property tax bills for 18 million households - 75% of the country.

Join the growing movement of people who want a fairer deal. Add your voice and sign the petition here.

MP urges govt to abolish council tax and stamp duty

This article was first published in the FTAdviser on 01/10/2020. The original article can be read here.

A Conservative MP, who once ran a national chain of estate agents, has written to Boris Johnson urging him to abolish stamp duty and council tax.

Kevin Hollinrake, who is the MP for Thirsk and Malton, urged the prime minister to replace the present system of council tax and stamp duty with what he calls a “proportional property tax” at a flat rate of 0.48 per cent annually.

This would be split between national government and the local authority, with 0.32 percent going to the latter.

The tax would be levied on the value of a person's property each year with those owning more than one home paying the levy on each property they own.

Deferral options would be available for the elderly and asset rich but cash poor.

He said under the current framework the effective tax rate on residential property in the North East of England was 0.7 per cent, but a mere 0.2 per cent in London, despite property values being higher in the south than the north.

This is because council tax is calculated based on the value of a property decades ago, rather than its value today, so the rise in London and south eastern property prices in recent years has not been reflected.

His plan would also involve taxing land banks owned by developers at the same rate.

In Mr Hollinrake’s letter to the PM, seen by FTAdviser, he wrote: “Stamp duty acts as a simultaneous break on social mobility and [on people’s] willingness to downsize.

"Recent stamp duty announcements are welcome, but they have not addressed the fundamental inequities associated with taxing property transactions.

"Some, of course, will argue that this [proposal] is a wealth tax, in my view it is no more so than business rates, which is also a proportionate property tax."

David Hollingworth, director of communications at mortgage broker London and Country, agreed stamp duty could be a reason why some older people don’t downsize, but he added: “There are a lot of moving parts to that, people want to preserve the home they have for their children to inherit, and quite often, the supply of properties for people to move into is not great, especially as people are active for much longer.

"Also lots of people, rather than downsize, release equity from their homes and use that to help the next generation.”

Mr Hollinrake’s letter to the Prime Minister was written in conjunction with the campaign group Fairer Share, which did the policy research for the proposal.

It calculated that, if levied at 0.48 per cent of estimated property value, approximately 18m households in England would see a reduction in their tax bills.

Despite this, the proposal would be revenue neutral, it would not cost the government money, nor would it generate extra revenue.

Mr Hollinrake’s letter asks for a meeting with Mr Johnson to discuss his plans in more detail.