Fairer Share in The Labour List: 'Labour needs a big, bold cost-of-living win – property tax reform can deliver'

Fairer Share founder Andrew Dixon has written for LabourList on why Labour has a once-in-a-generation opportunity to deliver a bold cost-of-living win through property tax reform.

Read the piece here:

The latest polling makes particularly uncomfortable reading for Labour. The party now faces pressure on three fronts: Reform surging on its right, the Greens and Liberal Democrats consolidating disillusioned left and centrist voters, and growing unease on the Labour backbenches.

That makes the government’s renewed focus on the cost of living both necessary and politically savvy. Voters across the spectrum want action. But incremental tweaks, long interviews, and lists of achievements aren’t cutting through. They don’t feel big enough, and they don’t feel fair enough.

If Keir Starmer is to stabilise his coalition, he needs bold, eye-catching policies that do three things at once: deliver tangible gains for millions of households; clearly demonstrate who Labour is prepared to stand up for and stand up to; and speak to voters drifting not just to Reform, but also to the Greens and Liberal Democrats.

There is a policy that does all three, and it builds directly on steps the government has already taken.

In the Autumn Budget, the Chancellor announced a new ‘mansion tax’ on the most valuable homes. That move has several things going for it. The new higher council tax bands are progressive, asking more of those with the broadest shoulders. It will be based on current property valuations, breaking decades of reliance on valuations from 1991 to set bands. And it included deferral mechanisms, allowing asset-rich, cash-poor households to pay later — addressing one of the most common objections to property taxation.

But the logical next step is to go further. Scrapping council tax and stamp duty, and replacing them with a single annual Proportional Property Tax based on current values, would be one of the most powerful cost-of-living interventions a government could make – without costing the Treasury a penny.

This reform, championed by Fairer Share, the national campaign to reform council tax and stamp duty, would cut taxes for 77 per cent of households. Our analysis shows it means an average saving of £556 a year for around 18 million families. A Proportional Property Tax would end the absurdity of a system in which families in modest homes, including many renters, routinely pay more in council tax than owners of multi-million-pound properties simply because of their postcode.

Just as importantly, the politics stack up. New polling by Merlin Strategy for Fairer Share shows significant net support for replacing council tax with a proportional property tax among voters currently planning to vote for every major party in England — whether Reform, Conservative, Green, Liberal Democrat or Labour. Support outweighs opposition by wide margins across the board.

Reform supporters back it by almost two to one. They are the most likely of any party’s supporters to say it would “very positively” affect their cost of living. Meanwhile Liberal Democrat and Conservative supporters back the reform by more than three to one, and Labour and Green voters back it by more than eight to one.

It’s not a niche idea – it has the potential to unite not only voters across the political spectrum, but restless MPs whose loyalty Starmer now needs. Backing for reform stretches across Labour’s internal spectrum too: from Blue Labour champions Jonathan Brash and Jonathan Hinder, to Red Wall caucus convenor Jo White, to Socialist Campaign Group members such as Andy McDonald, and Progress co-founder Liam Byrne.

Few policies can unite such a broad coalition. Fewer still allow Labour to significantly undercut rival parties’ cost of-living offers, while reinforcing its credentials on fairness.

The case for reform is straightforward. Council tax is still based on valuations carried out over a third of a century ago. In effect, homeowners in areas of rapid house-price growth have enjoyed a three-decade tax holiday, while everyone else has paid the price.

No serious tax system would tolerate that. Voters increasingly don’t either: a large majority of supporters of all five parties agree that properties should be revalued so taxes reflect today’s market.

Of course, some wealthy and well-organised homeowners would object. But the Mansion Tax has already shown how those concerns can be managed, through careful valuation, clear thresholds, and deferral options. Politically, that resistance may be an asset rather than a liability: voters want to see clearly who Labour is prepared to challenge.

The government already has a practical route forward. Planned consultations on new higher council tax bands provide the perfect launchpad for full revaluation. Publishing that data would expose the scale of under-taxation at the top end, not just for £2m-plus homes, but for many high-value properties currently sitting comfortably in frozen bands.

New bands are welcome. But on their own, they are a sticking plaster on a fundamentally broken system.

Keir Starmer warned against “sticking-plaster politics” in his New Year message two years ago – lamenting Westminster’s tendency for short-term fixes over long-term cures.

Reforming Britain’s property taxes would show he meant it. And if Labour is serious about rebuilding its electoral coalition — from Reform-leaning voters, to Green-curious urban seats, to frustrated MPs on Labour’s backbenches — it is a reform whose time has clearly come.

LBC Interview: Why Council Tax Is Broken, and the Case for a Proportional Property Tax

Fairer Share founder Andrew Dixon joined Matthew Wright on LBC this weekend to unpack why Council Tax is failing households and councils alike, and what real reform could look like.

The conversation explored how decades of cuts to local government funding have left councils struggling to provide essential services, from social care to road maintenance, while households face ever-rising bills. Andrew highlighted how Council Tax, still based on outdated 1991 property values, has become deeply regressive, with lower-value homes often paying a far higher proportion of their value than multi-million-pound properties.

Andrew shared real-world examples of this imbalance, including modest flats paying more in Council Tax than luxury mansions just miles away, underlining why the current system punishes low and middle-income households while failing to provide stable funding for local services.

He also outlined Fairer Share’s proposal to scrap Council Tax and Stamp Duty and replace them with a Proportional Property Tax, paid by owners based on the current value of their homes. Under this model, around 75% of households would see their tax bills fall, with an average saving of £556 per year, while removing Stamp Duty would make it easier for people to move home for work, family, or downsizing.

While acknowledging the scale of the challenge, Andrew pointed to recent moves toward more progressive property taxation as a step in the right direction, and stressed the need for a full, independent review of Council Tax and Stamp Duty to deliver evidence-based reform.

The interview closed with a shared sense of urgency, but also optimism, that with public pressure and political will, the UK can build a fairer system that funds vital services properly and reflects people’s real ability to pay.

✍️ Take action

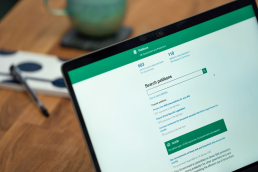

Fairer Share is calling on the Government to commission a full, independent review of Council Tax and Stamp Duty, so we can move toward a system that’s fair, evidence-based, and fit for today’s housing market.

If you agree that Council Tax is broken and needs fundamental reform, please add your name to our petition and help us build momentum for change.

Every signature strengthens the case for a fairer system that reflects real property values, supports local services, and reduces pressure on households.

Sign the petition and support the campaign today.

Fairer Share launches new petition calling for an independent review of Council Tax and Stamp Duty

It’s 2026, and the UK’s property tax system is still stuck in the past.

Council Tax is still based on property values from the early 1990s, so it routinely overcharges some households while letting others off far too lightly. At the same time, councils are left struggling to fund the local services we all rely on, and more and more people are falling behind.

That is why we’ve launched a new UK Parliament petition calling on the Government to commission a full, independent review of Council Tax and Stamp Duty, so the country can finally deliver the evidence-based reform the housing market urgently needs.

The system is in crisis, and the numbers are getting harder to ignore

Council Tax arrears across Britain have climbed to nearly £8.3 billion, a clear sign that the system is no longer matching people’s ability to pay.

In England alone, research cited by National Debtline suggests 2.2 million people were behind on their Council Tax bill as of March 2025.

Ministers have acknowledged the unfairness, too. In the November 2025 Budget speech, the Chancellor described Council Tax as a “longstanding source of wealth inequality”. But small tweaks and surcharges will not fix a system this outdated.

What the petition calls for

The petition urges the Government to commission an independent review that can look properly at:

- Council Tax, including the way it is calculated, who it hits hardest, and whether it provides a stable way to fund local services

- Stamp Duty, a narrow, one-off tax that distorts the market and discourages people from moving, even when their homes no longer fit their lives

Strong start, and we need to keep going

The deadline to sign is 23rd July 2026, so the earlier we build momentum, the harder this becomes to ignore.

If you agree, we deserve better than a broken system patched up with quick fixes:

- Sign the petition

- Share it with someone who’d back a fairer deal

- Help us show just how many people want a property tax system that actually makes sense

👉 Sign the petition

Fairer Share on ITV News: Time for a Tax System That Reflects Modern Britain

Property Tax Reform was front and centre on ITV News this week, as Fairer Share Founder, Andrew Dixon, made an appearance to highlight why now is the time to fix Britain’s broken property tax system and why the Proportional Property Tax (PPT) is the fairer alternative that would benefit millions.

For too long, Council Tax has disadvantaged ordinary people while multi-million pound properties in the wealthiest areas don't contribute their fair share. It’s still based on 1991 property values, meaning a semi-detached home in Sunderland can pay more than a townhouse in Westminster. And with the Autumn Budget fast approaching, this is a pivotal moment.

A pivotal moment

Local councils are warning of bankruptcy, the cost-of-living crisis is squeezing households to the limit, and both major parties are exploring property tax reform. The question now is whether the government will be bold enough to deliver a system that finally works for everyone. We can't afford to tinker at the edges with surface-level fixes to a system that's broken as its core.

Council band tweaks are just not enough when people have being pay well above their fair share for 30 years. And with cross-party support for property tax reform growing, now is a pivotal moment to get behind the Proportional Property Tax.

Why the PPT?

The Proportional Property Tax would replace Council Tax and Stamp Duty with one simple, transparent rate: 0.48% of your home’s current value. That means 76% of households would see a tax cut, saving an average of £556 a year, while councils would get the stable, long-term funding they need.

It’s a fairer deal for families, a smarter way to fund local services, and a policy that levels up the country by design by helping more deprived places like Sunderland, Hartlepool and Blackpool that have been overcharged for decades.

Now is the moment to act. The country can’t afford another patch-up of a broken system.

Take action

👉 Tell your MP it’s time for a Fairer Share: fairershare.org.uk/email-your-mp

Fairer Share on LBC News: Why Now Is the Moment for Property Tax Reform

Fairer Share Founder, Andrew Dixon, joined LBC News this week to discuss why Britain’s outdated property tax system is long overdue for reform - and why the Proportional Property Tax (PPT) offers a fairer, smarter alternative.

With the Autumn Budget fast approaching, all eyes are on the Chancellor and whether this government will finally take bold action to fix Britain's broken property taxation which have been unfair for over 30 years.

Why this matters now

Right now, Council Tax is still based on 1991 property values, meaning a family home in Blackpool can pay more than a mansion in London. Meanwhile, local councils are on the brink of financial collapse, and Stamp Duty continues to block housing mobility and growth. That’s why this is a crucial moment: the Chancellor is look at tax reform ahead of the Autumn Budget later this month, and both major parties are exploring property tax reform for the first time since Council Tax was introduced 30 years ago. The country can’t afford another tweak around the edges - we need bold tax reform and now is the moment to make it happen.

Benefits of the PPT

Under the Proportional Property Tax, all households would pay the same flat rate - 0.48% of their home’s current value - replacing Council Tax and Stamp Duty. It’s a simple, transparent system that means 76% of households would get a tax cut, saving an average of £556 a year, while local councils finally get the sustainable funding they need.

It’s fair, it’s growth-friendly, and it levels up the country by design, ensuring that those who can afford to pay more do, and those who can’t are no longer overburdened by a broken system.

Now is the time to act. With the Budget weeks away, it’s vital MPs hear from their constituents demanding a fairer, modern property tax system.

Take action:

👉 Email your MP today and ask them to back a Proportional Property Tax that replaces Council Tax and Stamp Duty.

Britain’s Property Tax System Among the Worst in the Developed World

New international data has laid bare just how broken Britain’s property tax system has become.

According to the 2025 International Tax Competitiveness Index from the Tax Foundation, the UK now ranks 37th out of 38 OECD countries for property taxes - the second worst in the developed world, behind only Italy.

A tax system holding Britain back

The report highlights how the UK’s property tax system distorts investment and productivity by taxing homes and buildings through outdated valuations and inefficient structures. Homeowners and businesses face higher bills not because their properties are improving but because the system fails to reflect real, up-to-date values fairly across the country.

This broken design discourages mobility and deepens regional inequalities. By contrast, countries like Estonia and Australia, which have reformed their systems to make property taxation more transparent and consistent, rank top globally for property tax design.

The heaviest property tax burden in the OECD

The UK also places the heaviest property tax burden in the OECD, collecting 2.6% of the country’s private capital stock through property taxes - far higher than the next-closest nations, the United States (1.8%) and Canada (1.6%).

That means British households and businesses are paying more through inefficient property taxes than almost anywhere else in the developed world.

A clear case for reform

Fairer Share has long argued that Britain’s property tax system - still based on 1991 house prices - is outdated, unfair and economically damaging. Families in modest homes in towns like Blackpool and Sunderland are paying far more than people in multi-million pound properties in London and the South East.

The Tax Foundation’s findings back up what millions of households already know: Britain’s property tax system is failing.

Replacing Council Tax and Stamp Duty with a simple Proportional Property Tax would create a fairer, more efficient system that supports local government, encourages investment, and boosts regional growth.

It’s time to fix Britain’s broken property tax system and make sure every household pays their fair share, based on what their home is really worth today.

Fairer Share on BBC South East Politics

Today, Fairer Share Founder, Andrew Dixon, appeared on BBC Politics South East to explain why Britain’s outdated property taxes are failing families and starving councils of stable funding - and why a simple Proportional Property Tax (PPT) is the fair, modern fix.

The discussion highlighted growing momentum for property tax reform ahead of the Chancellor's Autumn Budget and the real-world impact a fairer system would have across the South East and beyond.

What is the Proportional Property Tax?

The Proportional Property Tax would replace Council Tax and Stamp Duty with a single, simple charge set as a proportion of a home’s current value. It’s designed to be fairer and more transparent than the current Council Tax System. Under Fairer Share’s proposal, 76% of households would pay on average £556 less per year, while those with the most expensive properties contribute a fairer share to local services they rely on too.

Cross-party momentum is growing

Support for fixing Britain’s broken property taxes now stretches across the political spectrum. In recent months, Labour MPs have publicly urged the Chancellor to scrap the current Council Tax system and pursue fairer alternatives, while Conservative-leaning voices and policy groups have opened the door to replacing Stamp Duty and modernising local property taxes. That consensus: the status quo isn’t working, and reform is overdue.

This isn’t a left-or-right question - it’s a fairness and growth question. A well-designed property tax, such as the Proportional Property Tax can lower barriers to moving home, support local services, and reduce regional inequalities that have widened under a system stuck in the past.

How you can help

Property tax reform is on the table nationally. Media scrutiny, cross-party interest and real pressure on council finances mean this is a live debate ahead of the Autumn Budget and your MP needs to hear from you.

Add your voice now:

👉 Email your MP in 30 seconds and ask them to back a Proportional Property Tax that replaces Council Tax and Stamp Duty.

Labour MPs call on the Chancellor to fix Britain’s broken property tax system

As the Autumn Budget approaches, one issue is rapidly climbing the political agenda - fixing Britain’s broken property tax system.

This week, 17 Labour MPs, led by Jonathan Brash, MP for Hartlepool, have written a letter to Chancellor Rachel Reeves urging her to launch a full review of property taxation ahead of the Autumn Budget.

Their message is clear: Council Tax is outdated, unfair and holding back regional equality.

A system stuck in 1991

Council Tax was designed more than 30 years ago and is still pegged to 1991 property values. In practice, that means a family in a modest home in the North of England can pay more in Council Tax than someone living in a multimillion-pound London townhouse.

The result is a postcode lottery that places the burden on working families in the North, while wealthier households in the South East don't pay their fair share.

Our analysis shows that nine of the ten constituencies with the highest Council Tax burden relative to property value are in the North, while all ten of the lowest-burden areas are in central London.

That’s not fairness - it’s a broken system that taxes the poorest more heavily than those who can afford to pay more.

Time for bold reform

The MPs’ letter calls on the Chancellor to take bold action - to launch a root-and-branch review of property taxes and to show that Labour is serious about delivering for working families.

Property tax reform could:

-

Cut unfair bills for millions of households.

-

Boost regional equality by redistributing fairly across the UK.

-

Strengthen the public finances by replacing outdated, inefficient taxes with a modern system fit for today’s economy.

As one signatory put it, adopting this would show that Labour is ready to deliver - not just talk about fairness, but make it real in people’s lives.

The solution: a Proportional Property Tax

Fairer Share’s proposed Proportional Property Tax would replace Council Tax and Stamp Duty with a simple, fair system based on the current value of homes, so those with more pay more, and 18 million households would pay less.

The average household would save £556 a year, while local councils would see their funding rise sustainably and fairly.

It’s a growth-friendly model that will level up by design.

A fair deal for every community

The MPs’ letter sends a strong message: if Labour wants to show it’s listening to ordinary families, it must start by fixing the most unfair tax in Britain.

Broken tax means broken trust. Fixing Council Tax is how we restore both.

Fairer Share featured in Tax Journal

We’re delighted that Tax Journal, the UK’s leading publication for tax professionals, has featured an in-depth article by our founder, Andrew Dixon OBE, on the urgent need for reform of property taxation.

Andrew’s article, Property taxation reimagined, sets out why the current system of Council Tax and Stamp Duty Land Tax is unfair, distortionary and outdated - and why a Proportional Property Tax (PPT) offers a fairer, simpler and more sustainable alternative.

Drawing on economic analysis, international examples and Fairer Share’s own policy work, the piece highlights:

-

How Council Tax, still based on 1991 values, punishes households in poorer regions while letting multimillion-pound homes off lightly.

-

How Stamp Duty discourages mobility, trapping people in unsuitable homes and distorting the housing market.

-

Why incremental tweaks to either tax only add complexity, and why systemic reform is needed instead.

-

How a Proportional Property Tax would replace both taxes with a fair annual levy based on up-to-date property values — cutting bills for around three-quarters of households while providing stable revenue for local government.

Being published in Tax Journal is a significant milestone: it shows that the debate on property tax reform is no longer confined to campaigners and economists - it’s now firmly on the radar of policymakers, practitioners and professionals.

You can read the full article here: Download the PDF

At Fairer Share, we’ll continue to make the case for bold reform that delivers fairness for households, stability for councils and growth for the economy.

What Counts as a Mansion? Let’s Talk About What’s Really Unfair

by Andrew Dixon, Founder and Chairman of Fairer Share

The Mansion Myth

What is a mansion, anyway? James Max asks the question in the Financial Times while at the same time answering it himself. He conjures up Downton Abbey visions - 30 bedrooms, ballrooms, turrets and helicopter pads - and then tells us that a £1.5 million property in London is “just a house.”

Here’s the contradiction: Max knows perfectly well what a mansion is. Yet when it comes to paying a fair share of tax on high-value properties, suddenly the definition becomes slippery.

£1.5 Million Is Not “Just a House”

The truth is simple: £1.5 million is around 15 times the median UK house price. That’s not “just a house.” For the vast majority of people in the UK, it’s a dream they’ll never come close to. To dismiss it as ordinary, or as “Middle England,” reveals a gulf between those at the top of the property ladder and everyone else.

The Real Problem: Upside-Down Taxation

And this is where the current system is so deeply broken. Council Tax charges ordinary families in modest homes far more, as a share of their property value, than the owners of million-pound houses. Someone in a small terrace in Blackpool or Hartlepool can be paying double the tax rate of someone in a Kensington townhouse. That is upside-down taxation - and it’s corroding trust in local democracy.

The Proportional Property Tax Solution

That’s why Fairer Share is calling for a Proportional Property Tax (PPT). It’s a simple, transparent idea: properties are taxed according to what they’re worth today, not based on 1991 valuations frozen in time. Under PPT:

- 18 million households would pay less, saving the average family £556 a year.

- Those who’ve gained the most from decades of house price inflation would contribute a fairer share.

- Local councils would be properly funded to deliver the services we all rely on.

Who Really Counts as “Middle Class”?

James Max claims this debate isn’t about “soaking the rich” but about “wringing out the middle classes.” Yet his “middle class” turns out to mean households sitting on £1.5m assets. The real middle class - the millions of families earning average wages and struggling with rent or mortgages - are nowhere in his story.

The Ultimate Irony

And the ultimate irony? Max says he doesn’t mind paying for “roads, hospitals, the occasional police force”, while opposing a fair property tax that would help fund exactly these things.

Building a Fairer System

What is a mansion? The truth is that it doesn’t matter. What matters is whether our tax system reflects today’s reality or whether we let outdated council tax bands and political scare stories keep punishing those with the least.

Fairer Share’s Proportional Property Tax is not about envy, or poetry, or playing word games with “mansions.” It’s about building a tax system that is fair, transparent, and fit for the 21st century.