Jill Mortimer MP | The red wall deserves a fairer council tax system

This article first appeared in The Times on the 10th February 2022, written by Jill Mortimer, Member of Parliament for Hartlepool.

The Government’s Levelling Up White Paper is a far-reaching plan to unlock the potential of people and places in every part of the country in the years ahead. But as the cost of living crisis bites, it’s clear that the levelling up agenda needs to work for people in the weeks and months ahead. Alongside long-term plans and medium-term missions, we need short-term solutions to put more money in peoples’ pockets.

I know that the Government gets this. The white paper recognises that certain communities and people need greater support in the more immediate term. The policies set out by the Secretary of State for Levelling Up will begin to have visible effects, on high streets and in local communities, in the next few years.

More immediately, action is being taken to limit the impact of soaring energy prices on poorer households. Under plans announced by the Chancellor last week, millions of people in council tax bands A to D will be given rebates on their bills worth hundreds of pounds. This will be a vital financial lifeline for many of my own constituents, who do not live in expensive homes yet have been facing council tax bills of more than £2,000 a year.

By focusing on these council tax bands, the Government is ensuring that a broad range of households in modest homes are supported, including the very poorest and thousands of middle-income families. By and large, this is a demographic that deserves to reap the biggest benefits from levelling up. But why stop at a one-off payment?

The Government could and should still go further to fix one of the most outdated and unjust of all the taxes we currently have in the UK and put more money in peoples’ pockets. The absurdity of the council tax system is such that households in my own constituency currently pay out an average 1.31 per cent of their property’s value every year, while for residents of Westminster the council tax burden stands at just 0.09 per cent. In other words, council tax rates in Hartlepool are higher than they are for comparative bands in many other, and often much more affluent, areas of the country.

Even with the rebates, council tax will still be a system that favours millionaires rather than the millions. By taking bolder action to minimise the pain caused by council tax, the Chancellor would be steering the levelling up agenda towards a place where it can make a real difference to voters’ wallets today rather than in a decade’s time.

To deliver for voters in the red wall and beyond, the Government could revisit the outdated council tax banding system, which is based on 1991 prices and favours taxpayers in those areas where house prices have surged the most. This would be a much-needed step in the right direction. We should look closely at killing off council tax and replacing it with a fairer system that works for Hartlepool and the majority of the country.

In April, households are expected to see gas and electricity bills rise by 50%. This comes to about £600 for an average bill and, just like with council tax, Britain’s poorest households are set to be hardest hit. According to the Resolution Foundation, the poorest will see their energy spend rise from 8.5% to 12% of their total household budget. This is three times the proportion for the richest.

It is essential therefore that action to put more money in peoples’ pockets is at the heart of the levelling up agenda. In constituencies such as mine, many voters cannot wait until 2030 to find out how they may be better off. They are looking for answers today and the levelling up agenda needs to urgently provide them.

Responding to the Government's flagship Levelling Up White Paper, Fairer Share's Founder and Chairman, Andrew Dixon said:

“With the publication of the Levelling Up White Paper, Boris Johnson is promising jam tomorrow while refusing to lower bills today. If he was serious about levelling up, the Prime Minister would act now to bring in a tax policy that is pro-red wall and pro-working people. That means listening to many of his red wall MPs and backing a Proportional Property Tax. Doing so would make 76% of households better off to the tune of £435 a year, while sticking with the current system only means ever higher bills for already-stretched households. The reality is that the levelling up white paper is a dead duck and levelling up will never take off as long as the Government refuses to kill off our unjust and outdated council tax regime.”

New Report | Reforms to Council Tax could raise £4.5 billion each year from foreign buyers

Replacing Council Tax and Stamp Duty with a Proportional Property Tax would raise as much as £4.5 billion from foreign homeowners, empty homes and second homes.

This was the finding from our new report released this week, assessing the impact of international investors on the UK property market, and how property tax reform could help our economy in the future.

Introducing such a Proportional Property Tax, levied on the existing value of peoples’ homes rather than 1991 values (as is the current practice), would lead to 76% of households being better off, with an average saving of £435 per year.

Currently, foreign buyers in Westminster, for example, only pay a maximum of £1,655 a year. The much-needed reform of property taxes would see a surcharge of 0.96% levied on all foreign owned, second and empty homes. This would mean that an international buyer purchasing a £6.2m house in Westminster would pay £59,520 each year in local tax.

Council Tax is deeply regressive with those in low value homes paying more in proportion to the price of their home than those in high value homes. For example, in the Durham constituency of Easington, a family living in a home worth £100,000, presently pays over 1.4% of their home’s value in Council Tax every year. This rate is 52 times higher than the 0.03% rate which the £6.2m home mentioned above in Westminster would pay.

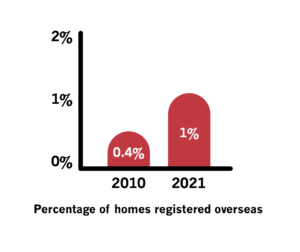

Whilst London remains the prime market for foreign investors, recent data shows that since 2010, overseas ownership has tripled to 250,000 homes across England and Wales, pricing out local households out of the market.

The report reveals that the policy’s surcharge would bring in as much as £4.5 billion in tax revenue, reduce bills for 76% of households and would also free up as many as 600,000 homes over 5 years, including a quarter of a million homes for 1st time buyers.

Calls for replacing Council Tax are set to grow louder this year as the cost of living crisis intensifies. Our polling carried out last year highlighted how Council Tax was the most disliked tax in the country with over 50% saying it was worse than Income Tax, Inheritance Tax and Capital Gains Tax.

The latest findings put further pressure on ministers to bring in a Proportional Property Tax, which has the support of a number of Labour and Conservative MPs, think tanks and the CLG Select Committee.

- John Stevenson MP for Carlisle, stated, "If we are to fix the housing market so that more young people can have a home of their own, then ministers should give serious consideration to taxing the high numbers of foreign investors in the UK. The best way of achieving this could be through a Proportional Property Tax, freeing up homes up and down the country.

- Lord David Willetts a former Conservative Minister, has previously said, “We've got to help young people get started on the housing ladder, and [a Proportional Property Tax] would bring more houses onto the market and would mean that people in low-value houses will not be paying so much tax”.

- Andy Burnham, the Mayor of Greater Manchester, also argued for replacing Council Tax with a new levy based on the value of your property, stating “The party can't tiptoe around it anymore”.

- The CLG select committee published a report in July last year recommending the introduction of a PPT, stating, “Council Tax is also an increasingly regressive tax that again penalises those in more deprived areas. A revaluation is long overdue”.

Reflecting on the report, our Founder, Andrew Dixon said:

“The Government is under increasing pressure to get to grips with the housing crisis and ensure foreign homeowners pay their fair share of property tax. Adopting a Proportional Property Tax would mean lower bills for the majority of households in the UK while the surcharge on these purchases would lead to hundreds of thousands of homes coming onto the market for UK residents.”

This article first appeared on Bright Blue's website, as the winner of the 2021 Tamworth Prize, which this year called for entries on how the Government could revive 'left-behind' areas.

When William IV appointed Sir Robert Peel as Prime Minister against the expressed will of the electorate, Peel was forced to prove that his brand of Toryism was in the electorate’s best interests. Boris Johnson finds himself in a very similar position today. Through the electoral benefits of Brexit, the Conservatives have found themselves controlling large swathes of the north – if he’s to stay in Government he must finally take regional inequality seriously – levelling up is the Government’s attempt to do exactly that.

New research into cash benefits has found that the best way to increase someone’s welfare is often to put more money into their pockets. A literature review conducted by the economist Ioana Marinescu found that unconditional cash transfers consistently are found to improve health and educational outcomes, and decrease criminality and drug & alcohol use. Moreover, a recent randomised control trial has found that these schemes can even increase the incentive to work. However, giving people direct payments is not the only way to increase the amount of money in people’s pockets. An easier way is to finally fix council tax.

The way council tax is currently calculated really makes no sense. It is based upon property valuations that are now 30 years old making it extremely regressive. This is because wealthier regions have seen higher levels of house price inflation than less well-off regions. The effect is that those in London pay council tax based on massive undervaluations and those in the north are largely paying based on overvaluations. To make things worse the rates are set locally forcing poorer authorities with higher welfare bills to set higher rates than wealthier ones. Consequently, the effective tax rate in the north east is now 3.5x larger than it is in London. Given this it is no wonder that over 3.5 Million people are currently behind on their council tax bills.

By fixing the council tax system, we can lessen the burden put on the areas that need assistance by putting more cash in hands and increasing their quality of life. The best way to do this is the proportional property tax. This, as advocated by Fairer Share, would put a 0.48% tax on current property values. As well as evening up the divide caused by the out of date valuations we currently use, this move would also be broadly progressive and result in cash savings each year for 76% of households nationwide – the average household saving as much as £453 per annum.

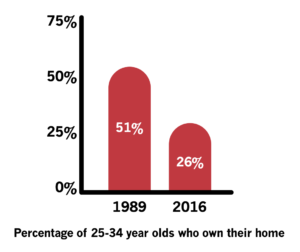

The most important benefits of this policy will be seen in precisely the areas the Government are targeting with their levelling up agenda. Across the 44 Red Wall seats that the Conservatives won in 2019, 97% of households would be better off with the average gaining £660 every year as a result of this change. Furthermore this wouldn’t just be a bribe to Conservative voters. Evidence from the Resolution Foundation indicates that it is the young who would benefit most from this reform – people who are unlikely to vote Conservative.

Thus, the Conservatives should introduce the proportional property tax not just because it would win them votes, but also because it’s the right thing to do.

Moreover, it will also help level up another group that suffers disproportionately under the current system. More than a fifth of young people currently live in overcrowded or concealed housing – and the tax system supports this. Those who live in under crowded conditions with multiple unused bedrooms currently have little incentive to downsize and so that stock is not made available. What PPT would do is incentivise those living in houses larger than they require to sell and purchase somewhere smaller to reduce their tax bill. Inadvertently this decision would increase the supply, and thus lower the cost, of those larger houses allowing more young people to live in homes appropriate for their needs.

It is a standard Conservative principle that the individual knows best when it comes to spending their own money – and modern economic evidence supports this. If we want to level up forgotten regions it cannot be done effectively through central state planning as this will only end up with bureaucracy taking over and inefficiencies ridding the project of its potential to create Adam Smith’s dream of universal opulence.

Like Peel abandoned Wellingtonite traditional Toryism in his Tamworth Manifesto to deliver 98 additional seats, Boris Johnson must too abandon council tax. Given the financial pressures the coronavirus has placed upon families, anything other than abolition would be actively causing harm to the poorest people in the country. PPT is the simplest way of creating a fairer system of property tax and would help put more money in the hands of those who need it most, and relieve the burden of council tax arrears that 5% of Britons are currently experiencing.

Tom is a Law student at City, University of London and is the winner of the Tamworth Prize 2021.

This article first appeared on Politics.co.uk on November 29th 2021, written by Grahame Morris, Member of Parliament for Easington.

Boris Johnson's social care plan is like a "classic Covent Garden pickpocketing operation", Keir Starmer said last week to much applause from Labour MPs at PMQs and some arresting headlines afterwards.

The image of Johnson and Rishi Sunak as street pickpockets worked well, as it did when Rachel Reeves deployed it in her well-received Budget response last month. It also forms a line of logic that leads Labour into some interesting new territory on how we tax homes fairly.

“It is not just broken promises; it is also about fairness,” said the Labour leader about the revised social care cost cap, which no longer includes council contributions towards total fees. “Under the Prime Minister’s plans, a person with assets worth about £100,000, most of it tied up in their home, would have to pay £80,000. They would lose almost everything.”

Labour is yet to detail our own social care plan, but the direction of travel is clear. Evidently, the leader rejects the concept of all homeowners paying the same towards social care regardless of the value of their property. Those living in areas in the North of England where house prices have hovered around the £100,000 mark for some years should not get the same treatment as millionaires living in London and the South East where prices have sky-rocketed, he suggests.

The position makes sense, coming in the wake of Labour analysis released at the weekend, showing how poorer Northern homeowners will end up losing a larger proportion of their wealth than better-off people under the changes. Homeowners in the North East will be particularly badly affected, with average prices under £186,000 in nearly 90 per cent of constituencies, while those in London and the South East will be less adversely impacted.

"In the so-called red wall, 97 per cent of households would be better off as a result of a proportional property tax"

But if Labour is to level the playing field then why stop at social care? The current council tax system also does exactly what he is railing against by forcing homeowners in modest homes in the North and the Midlands to pay out much more than their southern counterparts as a share of their home’s value every year.

In London and the South East, there are eight constituencies in which the average household pays no more than 0.20 per cent of their home’s value. But in many constituencies in the North and the Midlands, households must pay out a considerably higher share of their home’s value - going up to a whopping 1.41 per cent in my own constituency of Easington in East Durham. As a result, we currently have the absurd situation in which residents in my constituency face a council tax burden 14 times higher than that faced by residents of Kensington – and 24 times higher than people living in Westminster.

If we are to attack the government’s social care cap for hitting those with fewest assets the hardest, Labour should criticise the current council tax regime on the same grounds. Going further, we should be supporting plans to fix the problem without spending more money – by simply abolishing council tax and stamp duty and bringing in a fairer system of proportional property tax.

Under the model proposed by the Fairer Share campaign, property owners would pay 0.48 per cent of their property value each year and this tax would bring in exactly the same amount of revenue as stamp duty and council tax. Around 76 per cent of households across England would gain under the new system, seeing a reduction in the amount of tax they pay on their primary residence.

In the so-called red wall, 97 per cent of households would be better off as a result of the policy with an average saving of £660 per year. We need new ideas to rebuild Britain and Labour backing such a radical and progressive policy would help us beat the Tories at the next election.

Judging by his comments this week, Starmer already supports the principle behind a proportional property tax. The logical next step for him is to get behind a policy that is increasingly and unsurprisingly gaining support from the public as well as from MPs on all sides.

“He has picked the pockets of working people to protect the estates of the wealthiest" Labour’s leader told the Prime Minister at PMQs last week. I agree, and Labour should now apply the same principle and replace outdated council tax with a new, progressive and fairer proportional property tax.

Grahame Morris is Labour MP for Easington

This article first appeared in The Yorkshire Post on November 24th 2021, written by Andrew Dixon, Chairman and Founder, Fairer Share.

What exactly does the Prime Minister have against homeowners in the North?

For some time households in Yorkshire and beyond have been served up a rotten deal by our outdated and unjust council tax system. And now the Government made matters even worse with a social care cost cap that will hit Northern households hardest.

But as Boris Johnson stands accused of betraying the North, he still has an opportunity to get back in the good books of Northern voters. If he wished to do so, the Prime Minister could deliver serious cash savings to voters across the North just by fixing our broken council tax system ahead of the next general election.

For now, after a week of negative headlines in the North, the pressure is mounting on Ministers to do something that will work quickly and effectively. With the scaling back of the long-trailed Integrated Rail Plan, the Prime Minister found himself at odds with Northern MPs, regional leaders and industry figures, not to mention voters. But the rail plan was only the half of it.

With less fanfare the Government also quietly slipped out details of a new social care cap on home and care costs that will hit Northern households the hardest. The move to amend the cap will save Government hundreds of millions of pounds as subsidised care will not count towards the lifetime maximum.

It is argued that this means people with fewer assets – especially in this region – will end up losing a larger proportion of their wealth than better off people. Essentially, those who live in areas where house prices have not sky-rocketed in recent years stand to lose most.

According to Labour analysis, two thirds of poorer Northern homeowners will pay more towards their care under the changes. Don Valley, where the average property value is £155,000, is one of the constituencies expected to be hit hardest, while homeowners in the North East will be particularly badly affected, with average prices under £186,000 in nearly 90 per cent of constituencies. Meanwhile London and the South East will be less adversely impacted.

"The absurdity of the current council tax system is such that residents of Bradford East face a council tax burden nine times higher than people living in Westminster."

That would be bad enough if households in the North and Midlands were doing well out of other Government policies. Yet the same households are also the biggest losers under our current outdated property tax system based on house price values that are a year older than the very first text message and four years older than DVDs.

Presently, the average household in London presently pays out 0.24 per cent of their home’s value in council tax every year. Meanwhile, the average household in Yorkshire pays out 0.76 per cent and the figure is even higher in the North East. The absurdity of the current council tax system is such that residents of Bradford East face a council tax burden nine times higher than people living in Westminster.

There is no justification for the current unfair system. Especially when there is a straightforward and pain-free solution at hand. Unlike social care, the council tax problem can be easily solved without spending more money – by simply killing off council tax and stamp duty and bringing in a fairer system of proportional property tax.

Under the model proposed by the Fairer Share campaign, property owners would pay 0.48 per cent of their property value each year and this tax would bring in exactly the same amount of revenue as stamp duty and council tax.

A proportional property tax would mean lower bills for 19 million households across England, with households in the Midlands and the North seeing the biggest savings. In Don Valley, 98 per cent of households would see lower bills, with an average annual saving of £550. In Barnsley East, 100 per cent of households would see lower bills, with an average annual saving of £700. Across the ‘red wall’ some 97 per cent of households would pay less.

Unsurprisingly, a proportional property tax has been backed by a number of red wall Conservative MPs. Despite the pressure from his own side and Commons rebellion on Monday night, the PM is still sticking with the status quo when it comes to council tax. But with a cost of living crisis gripping the UK, and a social care cap and council tax system that together look like a double whammy of levelling down, it is surely time for the Prime Minister to change course.

Ultimately, if Johnson is committed to pushing through his rail and social care reforms against the interests of the North, then the least he can do is make property taxes fairer for households from Barnsley to Bishop Auckland.

He should accept that the game is up on council tax and seize the opportunity to move forward with a fairer system, delivering lower bills for millions of people in the North of England. By doing so, the Prime Minister could finally give Northern voters something tangible to celebrate.

Andrew Dixon

Chairman and Founder

Fairer Share

This article first appeared on Politics.co.uk on November 24th 2021, written by Tom Spencer, chief organiser of the London New liberals.

Boris Johnson is facing calls from more than 40 cross-party MPs to table legislation to stop the use of UK property for economic crime and nobody should be surprised. The size of the ecosystem profiting from our housing shortage by investing in prime London real estate cannot be understated and the Prime Minister should act immediately to tackle criminal behaviour lurking within it. But he should not stop there. We also need to fix the property tax system to ensure that all overseas non-resident investors pay up appropriately.

Data from Hamptons indicates that more than half of property purchases in prime London are by overseas investors; and, only 30% of these buyers are actually resident in the capital. From this we can estimate that around 20% of all sales are going to non-resident foreign buyers. This is why as much as one in five properties in the City of London are second homes.

This is particularly concerning given how often these investments are used to facilitate economic crime, with such ease of entry into the market lending itself to money launderers and fraudsters to use property for their personal gain.

Yet even if we ignore the criminality, the London housing market still provides a wonderful opportunity for investors to make money without actually doing anything productive. In real terms since March 1970 the average house has increased in value sixfold, this means investors can purchase a home, barely use it, and sell it on later for massive profits. All while contributing absolutely nothing back to society. And declining interest rates have made it easier for the wealthy to borrow against their existing assets in order to make more and more investments.

This is not a phenomenon that occurs internationally. In New York a 0.71% tax on annualised property values ensures that if one chooses to engage these rent-seeking tactics, then society is suitably compensated. The same occurs in Paris thanks to their wealth taxes on property. In contrast, London does absolutely nothing to stop these practices. Here, a rich Qatari family may buy prime retail estate through a shell company and not even have to pay any stamp duty.

It does not have to be this way. By copying the approach taken in New York we can tax non-resident overseas investors and both create a disincentive from them hoarding property, and if they choose to still invest, then ensure that the public is properly compensated for their rent-seeking.

"Given that around 5% of the value of the housing market is held by foreign non-resident buyers, valued at around £400 billion, a tax of just 1% of property values would raise as much as £4 billion every year."

This could be the first step towards much-needed reform of the entire system. For the past year, political support has been growing for the Fairer Share campaign to replace council tax and stamp duty with a simple tax of 0.48% on property values, with a surcharge rate of 0.96% on overseas non-resident investors.

As well as helping to address London’s problems with overseas investment, this would help to resolve many other challenges. For example, research estimates that anywhere from 170,000 to 600,000 more homes could be built as a result of this policy with the majority of these being in London and the South East.

The benefits won’t be restricted to London. Areas such as Norfolk and Cornwall have seen large increases in second home ownership which in turn prices out local residents. We know that outright bans simply shift the demand onto the existing stock making the situation worse for homeowners, but a proportional property tax would really help to level the playing field.

Moreover, where council tax under-taxes those in expensive homes, stamp duty penalises people for moving at all. This reform would provide an incentive for those in London’s 600,000 under-utilised homes to downsize, allowing those in overcrowded homes to upgrade more easily. As the cost of living crisis bites. it would also mean lower bills for 76% of households. On average, households would pay £435 less property tax a year under a system of proportional property tax.

The Prime Minister should take the action being asked of him to stop the use of UK property for economic crime. He should also commit to learning lessons from New York and taxing non-resident overseas investors. And if he really wants to deliver more homes, welfare gains and a fairer system across the country, he should commit to fixing property taxes across the board.

Leading LVT Campaigners | Fairer Share's Proportional Property Tax provides pathway to LVT

The UK’s tax system is not fit for purpose. It is complicated and is therefore regularly avoided and evaded. It discourages good investment in economically deprived areas and encourages land speculation which can make available premises too expensive for our future budding entrepreneurs.

Land owners suck the natural resource wealth from our economy that should be collected to replace unfair taxes such as Council Tax. An annual Land Value Tax would be the best mechanism to start rectifying this historical wrong whereby big owners of land not only have the advantage of controlling its use but reap the huge economic benefits of holding land – taking land wealth that is created by all of us in society. Support for a more progressive policy on property tax could also be a way to unite the Labour party around a radical vote-winning reform.

The Labour Land Campaign has been campaigning for Land Value Tax since 1983. At this year’s Labour Party conference, we shared a stall with the Fairer Share campaign which is backing a proportional property tax (PPT) which would be a simple flat rate of 0.48% on the value of a property.

The discussions around PPT naturally led on to the question “why include the building in valuing domestic properties for PPT?” That is a good question because why would we want to penalise owners of good buildings that are attractive with enough, well-proportioned rooms for their families, that use water economically, have good insulation and which enjoy green energy.

Supporters of an annual Land Value Tax (LVT), whereby all land is valued at its optimum permitted use and an annual levy is charged, argue this very point but many recognise the value of PPT and how its acceptance as a good replacement for Council Tax naturally leads a pathway to supporting an annual LVT not just on residential land but on all land. LVT will bring idle development sites into full use, see empty or underused buildings fully occupied, encourage the beneficial use of land in our towns and cities which will reduce the demand to build on green spaces or greenfield land thus protecting both our countryside and urban green lungs. Land speculation will become unprofitable and empty flats bought in the expectation that land values will increase, will become much needed homes.

As well as discouraging home improvements another problem with PPT replacing Council Tax is that the Treasury will need to redistribute from Councils with a PPT surplus to Councils with a deficit.

In the past brilliant new initiatives were piloted by local Government long before they were adopted by Westminster. For example, many councils opened local hospitals and clinics giving free health treatment decades before the NHS was introduced by the 1945 Labour Government. Similarly, town planning, bus passes for pensioners, electricity generation, police forces, cheap fares on public transport with integrated ticketing were all pioneered by progressive local authorities. Even the pilot study for the hugely successful Eden project in Cornwall was funded to the tune of £26k by Restormel Borough Council in the mid-1990s. Whitehall, and especially The Treasury, has never been known for blazing a new trail or taking risks and without an independent local tax base giving councils the ability to respond to local ideas and demands, the UK could lose future creative experiments that ultimately benefit everyone.

We envisage PPT providing a pathway to LVT whereby local authorities collect PPT but in addition (and maybe at a later date) the national government could introduce LVT on all land throughout the country. The economic merits for taxing land rents have been acknowledged by most thoughtful economists from Adam Smith to many Nobel prize winners such as William Vickrey and Joseph Stiglitz. Unlike taxes on wages or production LVT does not distort the economy and any effects it has on individual behaviour is entirely beneficial as using all land and natural resources more efficiently not only recognises their scarcity but also creates useful employment and protects green spaces. An Annual Land Value Tax is not only the best wealth tax (you can’t hide land like a valuable painting or cash) but it is unique as taxes go as LVT is actually a wealth creating tax.

Where there are examples of residential owners genuinely not being able to afford an increase in their PPT or LVT bill over what they currently pay under Council Tax, the unaffordable bill can be “rolled-over” to be paid when the home changes ownership. Local Authorities can still borrow against this anticipated future income as happened with Transport for London’s Supplementary Business Rate levied on just a few commercial properties to part-fund the building of the Elizabeth line.

Organisations that support an annual LVT vary in their make-up and include a broad spectrum of political groups, environmental campaigns, those arguing for fair taxes, business representatives, housing campaigns and so on, they argue LVT is not a “left-right” issue but it is a “right-wrong” issue.

By working together, the success of Fairer Share’s Proportional Property Tax should lead its supporters to understand the relevance of land wealth in the economy and support the arguments for an annual Land Value Tax to replace current property taxes and other distortive taxes that discourage good behaviour and reward bad behaviour.

Dave Wetzel, Vice Chair, Coalition for Economic Justice (www.c4ej.com) and Heather Wetzel, Vice Chair, Labour Land Campaign (www.labourland.org)

The Government is running out of excuses for sticking with the status quo.

Government response to the HCLG Select Committee report on local authority financial sustainability and the section 114 regime - a response from Fairer Share

The Government is missing a clear-cut opportunity to level up by refusing to consider the Housing, Communities and Local Government Select Committee’s suggestion that it should consider options for wider reform of council tax, including a proportional property tax. What’s more, the Government’s explanation for why it is sticking with the status quo does not stand up to scrutiny.

1. The Government states: “Council tax provides stable income for local authorities to deliver a range of vital local services, and predictable bills for taxpayers."

With upwards pressures on spending forcing councils to raise ever more revenue through council tax, it is surely debatable as to whether the levy provides stable income for local authorities. Also, there is no reason why council tax would provide local authorities with more stable income than would be the case with a proportional property tax. To ensure stable and balanced revenues, we propose that in areas where proportional property tax revenue is higher than that raised by council tax, the extra will be used by central government to compensate councils which raise less in proportional property tax than they do in council tax.

As for the claim that council tax provides predictable bills for taxpayers, the only predictable thing about many council tax bills is the unfairness that is baked into them. Based on property values that are thirty years out of date, council tax ensures that households in low-value homes must pay out a far higher share of their property’s value in tax every year than those in more expensive homes. It also hits renters saving up for a deposit just as hard as those who have made it onto the property ladder.

2. The Government states: “A revaluation would be expensive to undertake and could result in increases to bills for many households.”

At some point the Government will have to undertake revaluation. Using 1991 house values will just entrench and worsen existing inequalities and seem ever more outdated and ridiculous. Letting this problem slip into the future is short-termist and will be harmful to the Government and the Conservative Party’s manifesto commitment to level up.

We commissioned the well-respected International Property Tax Institute (IPTI) to write a 200-page deep dive into the issue of valuation. Other jurisdictions manage to provide accurate valuations of the capital values of their properties – Netherlands, New Zealand, British Ontario, New York. For a country that prides itself on data analytics and AI your concerns around valuation are insufficient.

In IPTI’s view, the introduction of PPT poses no insurmountable technical or valuation issues. As we have already stated, much of the rest of the world operate similar systems and they have proved reliable and sustainable.

There are implementation costs to be considered but, in comparison with the potential revenue to be derived from PPT, they would appear to provide good value for money in terms of cost/yield ratio. The Government already collects the requisite data at the VOA. To undertake a PPT it is a case of using the data correctly.

One thing that we do know about households bills that would result from the system we propose it that most would go down. Around 19 million households in England (76%) would gain under a proportional property tax, seeing a reduction in the amount of tax they pay on their primary residence.

3. The Government states: “The creation of higher council tax bands, which in itself would require a revaluation, may penalise people on fixed incomes, including pensioners, who could face a substantial tax rise without having the income to pay the higher bill.”

While a minority of people in valuable homes would see their bills go up after a revaluation, the Fairer Share system has built in safeguards to ensure that there are no losers on day one of a proportional property tax being implemented. For those staying in a high value home and paying the new tax, losses would be capped so that, at the point of transition, no household sees an increase of more than £100 per month on what they currently pay. But to ensure there do not have to be any losers on day one, there would be a deferral mechanism until point of sale on a low interest rate, so that nobody has to pay out immediately if they cannot afford to do so.

It is true that some asset rich, cash poor homeowners in valuable properties would see their bills go up under a system of proportional property tax. But many more people would see their bills go down and the alternative is sticking with a system which penalises renters and hard-pressed families in lower value housing.

4. The Government states: “Given that council tax is retained locally, a revaluation would not address the disparity between strength of council tax base and need.”

Again, this is misleading. Following a revaluation, under the Fairer Share model councillors would be able to set their own rate within a nationally-agreed range, maintaining vital local democratic connections (see more here). This would leave councils in a stronger position than now. Currently, councils can increase council tax a certain amount set by government, with central funds making up a large proportion of council budgets. With a proportional property tax, councils will still have flexibility within a nationally-agreed range and central redistribution will continue to make up a large slice of budgets.

The real difference with the new tax is that it will put cash in the pockets of the local people who are struggling the most, boosting local businesses and allowing councils to deliver better services.

What is perhaps most telling is that the Government’s 234-word defence of the current system does not mention the word fairness once. But perhaps we should not be surprised when we have such an outdated and unjust system. Nevertheless, the Government’s position is completely at odds with the its stated desire to level up the country. As council tax continues to rise, hitting hardest on renters and homeowners in lower value properties, we can clearly see that it has the effect of levelling down rather up.

It is evident from the Government’s response to the HCLG Select Committee that excuses for sticking with the status quo are running out. As the “cost of living” crisis hits households up and down the country, now is the time for ministers to take action where they can. That must mean killing off council tax and stamp duty and bringing in a system of proportional property tax that we know would bring about lower bills for most households.

Tom Spencer | Who wins gains? How capturing land value can revolutionise our infrastructure

This article first appeared in CapX on October 19th 2021, written by Tom Spencer, chief organiser of the London New liberals.

With the Government’s much-vaunted commitment to ‘Levelling Up’, public investment in infrastructure is all the rage. But who really reaps the reward when the state doles out taxpayers’ cash on improving our roads, railways and so on?

The simplest answer is that the benefits accrue to taxpayers themselves, both in terms of faster and more convenient travel and, in a broader sense, from a more productive economy. But on an individual level those gains are trifling compared to the gold-rush that new infrastructure can bring property owners in the vicinity of, say, a new train line.

With the Government’s much-vaunted commitment to ‘Levelling Up’, public investment in infrastructure is all the rage. But who really reaps the reward when the state doles out taxpayers’ cash on improving our roads, railways and so on?

The simplest answer is that the benefits accrue to taxpayers themselves, both in terms of faster and more convenient travel and, in a broader sense, from a more productive economy. But on an individual level those gains are trifling compared to the gold-rush that new infrastructure can bring property owners in the vicinity of, say, a new train line.

The basic idea is that government can offset the cost of construction against future revenues from business rates paid by firms operating in the area that benefits from new infrastructure. As Browne notes, TIF is particularly attractive because it doesn’t require any tax increases or funding from existing taxpayers.

From TIF to PPT

That still leaves us with the issue of capturing the surge in the value of residential properties, especially in London and the south-east, where homeowners have benefited from huge investments in projects such as Eurotunnel and Heathrow Terminal 5.

Given these unearned and largely untaxed gains it does not seem particularly fair that property owners pay a lower tax rate than other parts of the country which have not benefited from the same level of public investment. And, of course, the higher property prices in London and the south-east have made ownership much more challenging for younger generations and low income workers.

So how could we go about taxing that uplift in a sensible way?

The existing council tax system certainly isn’t fit for purpose, not least as it is based upon valuations conducted 30 years ago. As a result we now have a situation where residents in areas with high house price growth tend to be undertaxed. Absurdly, the wealthiest homeowners in Westminster, for example, have ended up paying less tax than the least wealthy homeowners in Hartlepool.

A better idea, advocated by campaign group Fairer Share, is to scrap Stamp Duty altogether and replace council tax with a Proportional Property Tax (PPT) of 0.48% tax on annualised property values. This means that when a new tube line is built next door to a house, and the value subsequently doubles, the owner’s tax bill will increase to reflect that.

Given that such a change would hurt the ‘asset-rich, cash-poor’ – such as pensioners with expensive homes but only a modest income –Fairer Share have suggested that tax increases should be capped at £1,200 a year. Those unable to afford that increase would have the option to defer the bill until the point of sale. Even so, the vast majority of people won’t need these protective measures and 76% of households would see an immediate reduction in their tax bills.

Taken together, Tax Increment Financing and a Proportional Property Tax offer innovative, fair and efficient ways of capturing the gains from new construction. With the Prime Minister faced with the twin challenges of levelling up and balancing the books, he could do a lot worse than giving both a try.