Featured in The Telegraph: Why Council Tax is Pushing Families to the Brink

The Telegraph shines a light on the harsh reality facing millions of families when it comes to Council Tax - we’re grateful to Maya Wilson-Autzen for bringing this issue to the forefront.

For many, Council Tax isn’t just a bill - it’s a burden pushing them to the brink. Louise and Dawn, supporters of Fairer Share, know this all too well.

- Louise, a teacher who has worked hard her whole life, is watching her bills soar beyond control. Now, she’s facing an impossible choice - stay in the home where she raised her children or downsize just to survive.

- Dawn’s family is paying £3,000 a year - yet a similar home just down the road is nearly £400 cheaper. How can a system be fair when two families in similar homes face such wildly different bills?

Andrew Dixon, chairman of Fairer Share, says: “Council tax has become an outdated and deeply unfair burden on hard-working families, particularly at a time when so many are struggling to make ends meet.

“The system is regressive, penalising households in less affluent areas while offering breaks to those in the wealthiest postcodes. It’s time for fundamental reform to ensure a fairer, more transparent system that truly reflects people’s ability to pay. A proportional property tax would ease the strain on millions and restore trust in how we fund our local services.”

This isn’t sustainable. This isn’t fair. And it doesn’t have to be this way.

Read the full article here.

Fairer Share on the BBC

Catch this eye opening segment on BBC Politics North here where the stark unfairness of the current Council Tax system is laid bare.

Did you know?

- A Band H property in Hartlepool pays an astonishing £4,755 per year, while a Band H property in Westminster is charged just £1,946 - less than half!

- In Peterlee, a Band B property pays £150 more in Council Tax than Buckingham Palace!

Labour MP Jonathan Brash speaks out on these shocking disparities and calls for urgent reform.

Our Founder, Andrew Dixon, was also interviewed to share why a Proportional Property Tax (PPT) is the solution - making the system fairer for individuals while empowering local councils and communities.

Andrew Dixon | A Unified Call to Reform the Country's Property Taxes and Build a Fairer System

Last week, Radix UK featured an article by Andrew Dixon, Founder of Fairer Share, in which he examined the pressing need for reform in the UK’s property tax system.

In this article, Andrew underscores the system’s fundamental flaws and inherent unfairness, emphasising how the outdated tax structure disproportionately burdens lower-income households and creates regional inequalities. Andrew argues that basing property taxes on actual property values, rather than outdated valuations, could lead to a more equitable and progressive approach. Such a shift, he suggests, would not only align with contemporary economic realities but also support sustainable growth and fairer opportunities for homeowners across the country.

You can read the article in full here.

A Call for Urgent Reform... An Open Letter to Starmer

Following Labour’s recent electoral victory, the need for a fairer, modernised property tax system is more pressing than ever. A letter addressed directly to Prime Minister Keir Starmer calls on the government to reform Council Tax and tackle the inefficiencies of Stamp Duty. This pivotal moment offers Labour a unique chance to align its policies with its manifesto commitments to drive economic growth, promote fairness, and improve housing accessibility.

Our sincere thanks to Jonathan Brash (Hartlepool), Liam Byrne (Birmingham Hodge Hill & Solihull North), and Grahame Morris (Easington) for spearheading this initiative, and to the many individuals and organisations that endorsed this call for change. It is inspiring to see such a distinguished coalition come together on this crucial issue.

You can read the letter in full below.

Dear Prime Minister,

Council Tax

Congratulations on your election success and the formation of a new Government. Your manifesto’s focus on economic growth and commitment to a progressive tax system is timely and crucial. An urgent priority should be reforming Britain’s outdated property taxes, which would significantly help Labour meet its manifesto commitments.

Council Tax is particularly problematic. Based on property values from over 30 years ago, it no longer reflects current prices. Its flat-band structure means someone in a £100,000 home pays six times more, as a share of property value, than someone in a £1 million home. This regressive nature disproportionately burdens young people, low-earners, and those in less prosperous regions. Reforming Council Tax to reflect actual property values would directly support Labour’s commitment to reducing economic inequality and easing the financial strain on struggling households.

The impact is stark: lower-income families are increasingly falling into debt. As of March 2024, outstanding Council Tax debt in England reached £6 billion, a 9% rise from the previous year. This surge in arrears is largely due to rising Council Tax rates, which have increased by up to 5% in many areas to cover escalating costs. Addressing this debt crisis through reform would help Labour meet its manifesto goal of ensuring economic stability and security for all.

If the Government wins a second term and delivers a decade of renewal but leaves Council Tax unreformed, then taxes in 2034 will be based on 1991 valuations. This is unsustainable.

Stamp Duty also presents challenges. While more progressive than Council Tax, it discourages homeowners from moving, leading to inefficient housing use. This stifles labour mobility and contributes to broader economic inefficiencies, such as people declining job opportunities due to the cost of moving. Reforming Stamp Duty could encourage a more dynamic housing market, aligning with Labour’s goals of boosting productivity and economic growth.

Both taxes have fuelled house price inflation and inefficient land use. Council Tax’s failure to keep pace with rapid house price growth over the past three decades has deprived the Government of essential revenues and inflated the housing bubble. Investors and second home buyers, who now represent about a quarter of all residential property sales, are crowding out owner-occupiers. Tackling these issues would help Labour fulfil its commitment to increasing home ownership and making housing more affordable.

To address the housing crisis, a multifaceted approach is required, including the modernisation of planning regulations, an increase in housing supply - especially social housing - and, most importantly, tax reform. The tax should be based on land values or updated property values, encouraging the efficient use of housing. To ensure fairness it should be based on individuals’ ability to pay. Such reforms would support Labour’s broader goals of building a fairer society and ensuring access to decent, affordable housing.

A fairer system is urgently needed to restore social cohesion, meet Labour's manifesto promises, and ensure that taxes raise sufficient revenue for public services while distributing the burden equitably. Reforming Council Tax and Stamp Duty is a critical step toward achieving this vision.

Yours sincerely,

Jonathan Brash – Member of Parliament for Hartlepool

Liam Byrne – Member of Parliament for Birmingham Hodge Hill & Solihull North

Grahame Morris - Member of Parliament for Easington

Claire Aston - Director, TaxWatch

Sir Vince Cable – Former leader of the Liberal Democrats

Martin Daunton - Emeritus Professor of Economic History, University of Cambridge

George Dibb - Associate Director for Economic Policy, IPPR

Andrew Dixon – Chair, Fairer Share

Liz Emerson - Co-Founder, Intergenerational Foundation

David Gordon – Director, Bristol Poverty Institute

Rebecca Gowland - Executive Director, Patriotic Millionaires International

Emily Grundy – Director, Institute for Social & Economic Research, University of Essex

Gavin Kerr - Author of The Property-Owning Democracy

Robin McAlpine - Director, Common Weal

John Muellbauer - Professor of Economics, University of Oxford

John Myers - Director, YIMBY Alliance

Polly Neate - Chief Executive, Shelter England

Avner Offer – Chichele Professor of Economic History, University of Oxford

Robert Palmer - Executive Director, Tax Justice UK

George Peretz KC

Freddie Poser – Executive Director, Priced Out UK

Andrew Purves - Author of No Debt, High Growth, Low Tax

Ben Rich - Chief Executive, Radix Big Tent

Josh Ryan-Collins – Professor of Economics & Finance, UCL Institute

Murad Qureshi – Chair, Labour Land Campaign

Ryan Shorthouse – Chair, Bright Blue

Chris Smith - Managing Director, Centre for the New Midlands CIC

Will Snell - Chief Executive, Fairness Foundation

Danny Sriskandarajah – Chief Executive, New Economics Foundation

Beth Stratford - Economist and Honorary Fellow, UCL

Rory Sutherland – The Spectator

Ben Twomey – Chief Executive, Generation Rent

Cllr Tony Vickers - Co-founder, Liberal Democrat ALTER

Torrin Wilkins - Director, Centre Think Tank

Lord Ian Wrigglesworth Kt

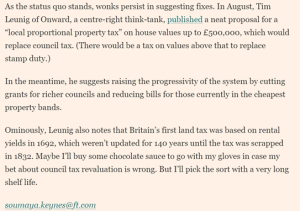

The Unfair Hole in Next Week's Budget

The Financial Times article, “The Unfair Hole in Next Week’s UK Budget,” critiques the government’s reluctance to address Council Tax reform, despite mounting calls for an overhaul. As the Budget announcement nears, meaningful changes to Council Tax - a system untouched since property values were last set in 1991 - appear unlikely. Over the past 30 years, substantial shifts in house prices mean many homeowners are paying taxes that bear little relation to their property's current value, underscoring the system's outdated and inequitable nature.

Tim Leunig of the think tank Onward proposes a “local proportional property tax” as an alternative, taxing properties up to £500,000 at a local level and using higher tax brackets to replace Stamp Duty on more valuable properties. This approach seeks to create a fairer, more progressive tax structure. Additionally, Leunig suggests reducing grants to wealthier councils to ease the tax burden on properties with lower values. Fairer Share, a group advocating for equitable taxation, has funded this research and supports Leunig’s model as a pathway to a fairer system.

The article highlights why politicians hesitate to tackle Council Tax reform. Many residents are unclear about what Council Tax actually funds, and shifting the system risks backlash from those whose bills might increase. Reform would also necessitate rethinking central government’s funding of local councils—a task many prefer to avoid. With the Budget approaching, the article argues that Council Tax reform remains a “black hole” in policy, largely ignored despite expert calls for change. Although the Budget may include tax tweaks, meaningful Council Tax reform seems unlikely.

Read the article in full here.

Former Sunak adviser urges Labour to introduce wealth tax on housing

In recent years, the push to reform local government finance has gained significant traction. A growing consensus among parliamentarians, think tanks, economists, and campaigners underscores the urgent need to replace the regressive Council Tax and the anti-aspirational Stamp Duty with a more equitable Proportional Property Tax. Tim Leunig has made three key recommendations: implementing a clear distinction between national and local funding, introducing a minimum payment to safeguard essential local services, and advocating for a more efficient property valuation process. These innovative proposals deserve serious consideration from the new Government, and we strongly urge them to give this paper the attention it merits.

You can read the full article featured in The Guardian here.

Sunak's Blind Spot: Council Tax Reform Remains a Political Opportunity

Despite its widespread unpopularity, successive governments have avoided tackling Council Tax reform, deeming it too challenging to address. While there has been occasional talk of adjustments, such as adding new bands to account for rising house prices since 1991, substantive reform remains elusive.

Although there is a clear connection between the cost-of-living crisis and the regressive nature of Council Tax, the government shows little interest in implementing meaningful changes to this outdated and unfair system of taxing people's homes.

With the cost-of-living crisis still hitting hard and essential expenses like energy, fuel, and food bills remaining high, now is the time for politicians to confront Council Tax. Reforming it would alleviate financial burdens for the vast majority of households across the country and potentially yield significant electoral advantages for whichever major party is willing to take the lead.

Extensive polling by JL Partners indicates that voters throughout the UK believe it is time to replace Council Tax and Stamp Duty with a simpler and fairer Proportional Property Tax, based on current property values. The findings suggest substantial electoral gains for either Conservatives or Labour if they were to endorse this policy. This is further supported by More in Common’s report, which highlighted that a pledge to reform Council Tax is at the top of everyone's manifesto wish list. In fact, according to James Johnson of JL Partners, “there is a huge electoral gift here for either party if they want to take it on”. So why are we not hearing more about it from party leaders?

Support for the Proportional Property Tax is highest among residents in lower-value homes in the North and the Midlands, who would benefit the most from significantly lower bills. Across England, households could see an average annual property tax saving of £556, with even larger savings in towns such as Blackpool South and Hartlepool. With Council Tax rises of up to 10% in some areas, the financial strains on households who are already grappling with rising living costs, are exacerbated.

When asked about a Proportional Property Tax, the Government responds by saying the tax would mean “soaring bills for many hard-working families and pensioners who have saved and improved their homes”. This shows a complete lack of understanding of the policy, which has significant safeguards in place to protect those who live in valuable homes but have limited income – the so-called “asset rich, cash poor”.

Regarding the Proportional Property Tax, Fairer Share’s founder, Andrew Dixon, says “Our fully funded solution presents a real opportunity for meaningful tax reform that addresses the cost-of-living crisis, bolsters public finances, and secures electoral advantages. The party that embraces this reform will create positive change, benefiting both the public and the country as a whole by addressing the unfairness of the current system and providing much-needed relief to households facing financial strain”.

The lack of meaningful Council Tax reform raises questions about whether it has been a blind spot for Sunak's administration. Despite the clear need for change highlighted by numerous MPs, think tanks, campaigners and economists, and the clear benefits of solutions like the Proportional Property Tax, the government's reluctance to address this issue raises concerns over its commitment to addressing the cost-of-living crisis and ensuring fairness within the tax system. Maybe Starmer will grasp the nettle? He has, after all, committed to “level up” regions more effectively than the Conservatives.

John Stevenson, MP for Carlisle | Council Tax has morphed into the Poll Tax

Council Tax has morphed into the Poll Tax and is a drag on rebalancing our regional economies - John Stevenson, Conservative MP for Carlisle

The Poll Tax was a deeply unpopular policy because, at its most basic level, it felt unfair. The problem was that it simply did not reflect an individual’s ability to pay. The poorest families and the richest families were expected to contribute an equal amount, meaning that, as a proportion of one’s income, the poorest were much worse off.

However, we are now in a position where its replacement, Council Tax, has morphed into a new version of the Poll Tax. And because of hugely imbalanced property prices across the country, it acts as a drag on rebalancing our regional economies and levelling up the areas of the country that need it the most.

Whilst Council Tax is somewhat more progressive – property value is banded and it is levied on capital value as opposed to notional rental value – it still fails to properly compensate for differences in actual income and wealth. Worse still, because of regional imbalances in property values that have only grown larger, the current system of Council Tax ingrains the disparity between the North and the South. The overarching reality is that, because property values have not been updated for over 30 years, Council Tax suffers from almost the same regressivity as the Poll Tax.

This is due to many features relating to the design of Council Tax. For example, the difference between bands is extremely small, making it resemble a per capita tax. Accordingly, the difference in payments between rich and poor is extraordinarily small. The fact that it is levied equally within bands means that the lowest-valued properties in each band pay a significantly higher amount as a percentage of their property value than the highest-valued property in that same band.

This is all before we look at the disproportionate effect that the tax has on the different regions of the UK, where property prices vary to such a wild degree. As property value in the South East has sky-rocketed, the relative cost of Council Tax to property value has plummeted in comparison to the rest of the country. Right now, someone in a £150,000 home in Bolton pays £1,000 more a year in Council Tax than someone living in an £8m mansion in Westminster.

So, by unintended effect, Council Tax has almost become the Poll Tax in all but name. It is time for the Conservative Party to finally put this right, by listening to their MPs, think tank Bright Blue and voters and introducing a proportional property tax. One idea, spearheaded by Fairer Share, would be to create a flat 0.48 per cent tax on residential property value. This would provide more than £550 of annual tax savings for 77 per cent of households.

A huge number of these households would be in the North and Midlands – meaning a substantial annual cash boost to those hard working families who pay Council Tax on top of all the other obligations they currently have. Levelling up, or any incarnation of that concept, can only happen when the people of those areas which need to be boosted become richer themselves and have more money to spend.

Furthermore, the incentive to live in an area where property prices are not only lower but where the tax attached to them is also lower would mean a huge rebalancing in the workforce – at once easing the burden in the South and opening up opportunities in the rest of the country, especially for those areas that have traditionally found it more difficult to attract skilled labour and talent.

Not only is this the right thing to do for the country, but there is also a politically necessary element to the reform. Recent polling has indicated that adopting this policy would be popular amongst a large number of voters, with a plurality, 41 per cent, supporting a proportional property tax and only 8 per cent opposing it.

This is not surprising, as 90 per cent of households in key constituencies would see a tax cut from this policy.

This reform is fully costed, will help to fund new infrastructure and, perhaps most importantly, will provide the Treasury with additional fiscal breathing room - a surplus of £5.6bn.

Some 32 years later, the Poll Tax riots still haunt the Conservative Party – which is why I think governments of all colours are loath to meddle with Council Tax. But there has to be a reckoning.

The Conservative Party should never be seen as the party of high taxes. Instead, we should aim to be seen as the party of fair taxes. Being an unfair tax is what did it for the Poll Tax - and Council Tax is now basically replicating this unfairness across the country. It is time to be bold and finally right the wrong that Council Tax has become.

This article was first published in The Yorkshire Post here.

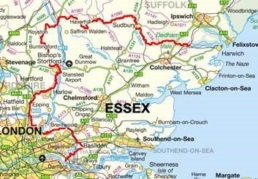

Families in Essex's poorest area hit with 'disproportionate' council tax burden

"People in Jaywick are paying at least three times more as a proportion of their property value in council tax compared to the most wealthy area of Hutton Mount in Brentwood."

Families in Essex's poorest area hit with 'disproportionate' council tax burden

An excellent piece, written by Piers Meyler and published in Essex Live, highlights the significant Council Tax disparities faced by families in Jaywick, Essex, the region with the highest level of deprivation. Recent findings shed light on the disproportionate burden, revealing that residents in Jaywick pay at least three times more as a proportion of their property value in Council Tax compared to wealthier areas such as Hutton Mount in Brentwood. This stark contrast has reignited calls for a reform of the current system, with the author advocating for a fairer approach through Fairer Share’s Proportional Property Tax.

Click here to read the full article.

Andrew Dixon | From Inequality to Inclusivity: Property Tax Reform and Labour's Vision for the UK

From Inequality to Inclusivity: Property Tax Reform and Labour's Vision for the UK

Andrew Dixon, Founder & Chairman of Fairer Share

The debate surrounding tax policy in the UK has intensified, with Rachel Reeves, the Shadow Chancellor of the Labour Party, ruling out wealth taxes. This stance has faced criticism in several articles from reputable sources such as New Statesman, The Guardian, and The Financial Times. Rachel Reeves' decision to reject wealth taxes and other tax increases is part of Labour's strategy to demonstrate economic competence and appeal to the corporate sector. However, critics argue that this approach misses opportunities to address wealth inequality and promote economic growth.

Harry Lambert, writing in the New Statesman, criticizes Labour's refusal to adopt tax reforms that shift the tax burden from labour to capital and wealth. These reforms could raise substantial revenue, potentially funding green energy initiatives or cutting income taxes for most people, while also addressing wealth inequality and boosting economic growth.

Josh Ryan-Collins, in The Guardian, criticizes Rachel Reeves' rejection of wealth taxes and her implication that lower taxes on the wealthy will lead to prosperity (trickle-down economics). The article argues that the UK's tax system incentivizes rentier capitalism, where capital gains are taxed less than income, resulting in a misallocation of capital that stifles growth and productivity. It contends that taxing wealth and capital gains while increasing public spending can help control inflation and promote progressive deflation, aligning with recommendations from organizations like the OECD, IMF, and the Institute for Fiscal Studies.

In the context of this ongoing debate surrounding taxation policies in the UK, if outright wealth taxes are ruled out, it is crucial to at least reform more regressive and punitive property taxes, notably council tax and stamp duty. Indeed, The Financial Times’ Editorial Board argues that council tax, stamp duty, and business rates hinder productivity and economic growth. The board proposes replacing council tax with an annual proportional property value tax based on updated valuations, gradually reducing stamp duty, and reforming business rates. These changes aim to address inequality and promote growth.

As we turn our attention to the next General Election, the Labour Party Manifesto serves as a roadmap for its policy priorities and aspirations when seeking to govern the country. By including property tax reform, the party would signal its commitment to addressing two of the most pressing issues in the UK: economic inequality and regional disparities. This commitment aligns with the party's historical values and its promise to create a fairer and more inclusive society.

Property tax reform, as outlined by The FT, Lambert and Ryan-Collins, can play a pivotal role in rectifying the regressive nature of the current tax system. Council tax, based on outdated property values, places a disproportionate burden on households in less affluent regions, exacerbating regional inequality. By pledging to replace council tax with an annual proportional property value tax, the Labour Party would demonstrate its dedication to levelling the playing field and ensuring that taxation is fair and equitable.

Furthermore, the inclusion of property tax reform in their manifesto underscores the Labour Party's commitment to fiscal responsibility. While advocating for tax reforms, Labour acknowledges the importance of maintaining local government revenue. By carefully phasing in changes, introducing caps and reliefs for vulnerable households, and deferring payments until property sale or death, the party can strike a balance between fairness and financial stability. This balanced approach resonates with voters who value responsible economic management.

Importantly, property tax reform is a policy that can capture the attention and support of a broad spectrum of voters. Proportional property taxes are commonplace in many countries indicating their feasibility and acceptance among the public. The proposal to cut taxes for three in four people while raising necessary revenue can be an attractive proposition for voters and help deliver a persuasive campaign platform.

In conclusion, while wealth taxes may be ruled out, including reform to property taxes, specifically council tax and stamp duty, in the Labour Party's manifesto is not only a strategic move but also a commitment to tackling regional inequality, fiscal responsibility, and an opportunity to resonate with voters across the political spectrum. By taking a stance that aligns with economic fairness and growth, the Labour Party can set itself apart and offer a compelling vision for the future of the UK's tax system and its broader society.