Panel Discussion | Home Truths: Reforming Property Taxes in the UK

Last week, to mark the first publication from the newly formed Tax Commission, think tank Bright Blue held a panel discussion of MP's, campaigners, journalists, and academics. The panel discussed the options for a new Annual Proportional Property Tax - one of the key recommendations of the report.

The Panel

Andrew Dixon | Our founder and the founding trustee of the Woodhaven Trust, Andrew has spent over two decades investing in small and medium businesses and is an Enterprise Fellow at the Prince’s Trust.

Kevin Hollinrake MP | Conservative MP for Thirsk & Malton and chair of the Property Research Group, Kevin has been a longstanding supporter of our campaign and advocate for property tax reform.

The Rt Hon Dame Margaret Hodge MP | Labour MP for Barking and chair of the APPG on Anti-Corruption and Responsible Tax.

Carol Lewis | Deputy Property Editor of The Times and Sunday Times, Carol has written extensively about our campaign and property tax reform.

Professor Paul Cheshire | Emeritus Professor of Economic Geography at the London School of Economics and consultant to the World Bank, OECD and UN.

Ryan Shorthouse | The Founder and Chief Executive of the Bright Blue think tank, Ryan will chair the discussion.

Sam Robinson: It’s Time to Deliver a Progressive Alternative to Council Tax and Stamp Duty

This article first appeared in Conservative Home on May 21st 2021, written by Sam Robinson, Senior Researcher at think tank, Bright Blue.

As the economy gradually reopens, jobs return to the labour market, and the vaccine programme roars ahead, it looks as though – after being blown wildly off course by the Covid-19 pandemic – the Government can soon return to its central mission of ‘levelling up’.

So far, the Government has prioritised spending and investment as the key levers to levelling up. But this approach is far from new. There have been countless regeneration initiatives since the 1960s, and governments of all stripes have pledged to improve life for deprived areas of the UK.

To truly address regional disparities and deliver on its levelling up agenda, this Government will need to be broader and more radical in its approach. That means reforming tax too.

The Government could start with our regressive and arcane system of property taxation. Council Tax, which still operates on property valuations from 1991, is laughably disconnected from today’s house prices. A house in Camden that cost £320,000 in 1991, for example, could now be worth £3,650,000, and still be in the same Council Tax band.

Property taxes in their current form also punish those in low-value properties, who pay proportionately more in Council Tax than higher-value properties. A property worth £25,000 in 1991, in a local authority charging the English average Band D rate, pays Council Tax at 4.7 per cent of its 1991 value. Conversely, a property worth £500,000 in 1991 pays Council Tax at just 0.7 per cent of its 1991 value.

Geographical variation in house price increases has exacerbated this trend further. While median house prices in many areas of London have risen eightfold between 1995 and 2020, prices in towns such as Blackpool have only increased by 2.7 times. The essential point is that those in the ‘Red Wall’ and so-called ‘left-behind’ areas are therefore paying more than their fair share in terms of Council Tax.

Meanwhile, Stamp Duty acts as a tax on aspiration, slowing the housing market and making it harder for people to find the right house for them. As witnessed during the pandemic, sudden changes to the Stamp Duty regime, such as the Stamp Duty holiday, can lead to significant fluctuations and spikes in the housing market.

It is little wonder, then, that figures from across the political spectrum – Conservative, Labour and Liberal Democrat alike, as well as economists, think tanks and campaigners – are united in calling for a fundamental reappraisal of the way we tax property.

There is now widespread, cross-party agreement that our property taxes are in urgent need of reform. The key challenge now is agreeing upon a way forward.

Bright Blue’s new report, Home truths: options for reforming residential property taxes in England, comprehensively assesses and ranks alternatives to our current system on a number of economic and political criteria. The report recommends replacing Council Tax and Stamp Duty with an Annual Proportional Property Tax (APPT) levied at a flat rate on the value of houses.

The APPT would have a £50,000 exemption threshold and a 25 per cent surcharge for second home owners. The tax would be charged on owners, rather than occupiers. Revenues would be split between national and local government. The fixed national component would be set at 0.11 per cent (0.14 per cent for second homes) of property value in order to replace Stamp Duty revenues, with English Local Authorities (LAs) free to set their local tax rates independently.

To explore the possible distributional implications of a move to this APPT, the report devises five plausible scenarios for the local APPT rates different LAs might choose to set post-reform.

The impact of a move to APPT is shown in two ways. First, by illustrating the proportion of LAs where a typical resident would pay less overall in expected property tax, in a scenario where LAs each charged the same local rate, designed to yield the same revenue as Council Tax does at present. With this, 78 per cent of all English LAs would see the typical resident face a lower expected property tax liability post reform.

Comparatively, those who face a higher expected property tax payment would be a typical resident in Greater London and the South East of the country.

Second, we simulate the impact on expected property tax payments before and after the proposed reform, using different scenarios for the local APPT rates charged, on a range of houses in ten representative LAs across England. The results show a pattern of reduced expected tax liabilities for those in poorer LAs such as Newcastle, and those in less expensive housing. In the lowest-priced housing market in England, Burnley, the cheapest houses are winners in all scenarios, and houses with a price at the market median also gain in all but two scenarios.

Combining the results of all the different scenarios, 76 per cent of the lowest-priced houses in the ten LAs pay less tax from moving to APPT, and 48 per cent of median priced houses and 24 per cent of the most expensive houses would also see reduced expected property tax liabilities. It is worth bearing in mind here that house prices are not normally distributed; there are relatively few expensive properties, and many more cheaper properties.

In other words, while the current system is regressive and distortive, an APPT would change this by rebalancing expected property tax liabilities and putting money in the pockets of those from modest backgrounds and areas.

Of course, such an ambitious overhaul of the property tax system will bring with it substantial challenges, including accurate valuation. But that is not a good enough reason to continue ducking this issue. To truly address the inequities and inefficiencies of Council Tax, the Government will have to face revaluation at some point. And to avoid a gradual return to the unfair discrepancies we see today, revaluations will have to be done on a regular basis.

The challenge of regular revaluations is also surmountable in a way that it wasn’t in decades past. Price data, house characteristics, and locations are now readily available, enabling house prices to be modelled. This modelling-based approach is a practical and comparatively cheap method for calculating property taxes; indeed, at least 15 countries have already implemented statistical mass appraisal systems for use in property valuations.

The flaws of Council Tax and Stamp Duty can no longer be ignored. Moving to an APPT makes both economic and political sense. If the Government is serious about levelling up in the long term, it needs to be bold now.

Sir Vince Cable: The Case for a Proportional Property Tax

This article first appeared in Politics.co.uk on May 13th 2021, written by former Business Secretary and MP for Twickenham, Sir Vince Cable.

With local elections just past, the return of local politics after an enforced absence has focused people’s minds on local services and how they are paid for. What is blindingly obvious is that local government faces extreme financial pressures that are proving hard to escape. The problem is local government’s dependency for revenue on central government, which has been cutting back for many years now, and an unpopular local levy in the form of council tax.

With the coronavirus pandemic having put further pressure on council finances, many are having to raise council tax, sometimes substantially. As a result, millions of council tax payers are facing increases of up to 5% in their annual bills.

Taxes are only ever popular when other people pay them. But there is no escaping the need to raise more revenue locally. And there is merit in a form of taxation which, as with property, cannot easily be avoided by carting it off to the Cayman Islands. Moreover, the artificial inflation of property values as a result of emergency monetary policy – QE – means that there is some justice to taxing the windfall.

Yet, as it stands, council tax is arbitrary and unfair. Its banding is based on ancient valuations. And the bands themselves are not even proportional to property values. Lower bands pay, proportionately, far more. This adds to the sense of unfairness around the tax. At present there are eight parliamentary constituencies in which the average household pays no more than 0.2% of their home’s value in council tax. However, there are 41 constituencies in the north and Midlands in which the average household’s council tax burden is 1% or higher.

There is a solution: to reform council tax by linking it to current property values on a proportional basis. The idea is not particularly revolutionary; it is used in the United States and parts of Europe. My party has been promoting it for some time but I am pleased to see that a significant number of Conservative and Labour MPs are now behind it.

The idea also has intellectual pedigree here in the UK with prominent think tanks and campaign groups including the Institute for Public Policy Research, the Social Market Foundation, Demos, the Centre for Policy Studies and the liberal Conservative Bright Blue group all supportive. In a letter sent to the chancellor earlier this year, they said property taxes must be reformed “so that they are based on today’s property values and homeowners’ ability to pay”. And if he were alive today, I suspect that the 18th century Scottish philosopher Adam Smith would also be an advocate.

To Smith, unearned income from any non-produced resources is a social evil. In The Wealth of Nations, Smith famously wrote that the interests of those who profit from this are “directly opposite to that of the great body of the people.” As in Smith’s day, the main example we see of this behaviour is in land. Whilst the days of aristocrats controlling the majority of land are believed to have ended, half of England is still owned by less than 1% of the population. If we’re to fulfil Smith’s dream of universal opulence then we cannot allow conditions to be maintained where great swaths of land owned by a tiny minority of people can be left unproductive.

To solve this problem, Smith proposes we tax that rent. Profiting off unproductive resources like land provides no benefit to society as a whole and only serves to entrench class divisions and foster inequality. Making rent-seekers pay for their rent encourages them to begin using their land more productively, helping to create more growth.

It is important to remember that Smith was no utopian. As his biographer Jesse Norman wrote, Smith was “concerned with specific remedies”. Had a policy existed that encompassed the benefits of the land value tax in a way that was politically expedient then it is likely that he would have endorsed it. This is why, if Smith were alive today, he would be supporting the campaign for the introduction of a Proportional Property Tax (PPT).

Rather than vaguely supporting a tax on rent, famously hard to calculate, PPT would look at the value of a home and tax it at a modest amount of 0.48% as a replacement to council tax and stamp duty. This could be exceptionally useful as a vote winner, with research from the Fairer Share campaign showing that a replacing both council tax and stamp duty with a proportional property tax would mean lower bills for more than three quarters of households in England.

Recent polling by the campaign also indicates that voters would welcome more local election candidates fighting to change the residential property tax system. Four out of ten people would consider switching their vote to a party pledging to replace council tax with a fairer property tax system with lower annual bills for most people and local services maintained at the same level, they found. And in the so called ‘red wall’ areas of the country, almost half of all people questioned (49%) would consider switching their vote on this basis.

A further benefit of PPT is the abolition of stamp duty. Over the last decade an array of research has shown that stamp duty massively disincentives people buying houses. Affordable housing has become almost impossible for young people to procure. This has a powerful impact across the country — indeed, in a 2017 paper The Adam Smith Institute calculated that abolition of stamp duty could stimulate as much as £10 billion in economic growth. By abolishing stamp duty we can begin making it easier for people to move houses, helping to free up the rungs at the bottom, and thus free up the supply of affordable homes.

Opponents of a proportional property tax point to practical issues, such as annual valuations, but work done by the International Property Tax Institute shows that there is no technical problem with revaluation. Hundreds of jurisdictions use some sort of automated valuation model to aid their property tax systems, and the Valuation Office Agency already has the required data in order to implement the system itself.

Amid ministers’ talk of building back better, excuses for inaction are running out. Any tax reform has to have cross-party support to be sustainable. Proportional property tax now does, having previously been largely the exclusive preserve of the Liberal Democrats. This should not be squandered. Now is the time for all politicians to call time on council tax and get on with the job of making our residential property tax system fairer.

Sir Vince Cable

Red Brick | Council Tax is regressive and broken, fixing it would be a progressive victory

This article first appeared in Red Brick Blog on May 5th 2021, written by our founder, Andrew Dixon.

New polling by the Fairer Share campaign hints at the huge potential gains in store for a party that is brave enough to reform our broken property taxes. With local elections around the corner, four out of ten people would consider switching their vote to a party pledging to replace council tax with a fairer property tax system with lower annual bills for most people and local services maintained at the same level. In the so called ‘red wall’ areas of the country, the figures are higher with almost half of all people questioned saying they would consider switching their vote.

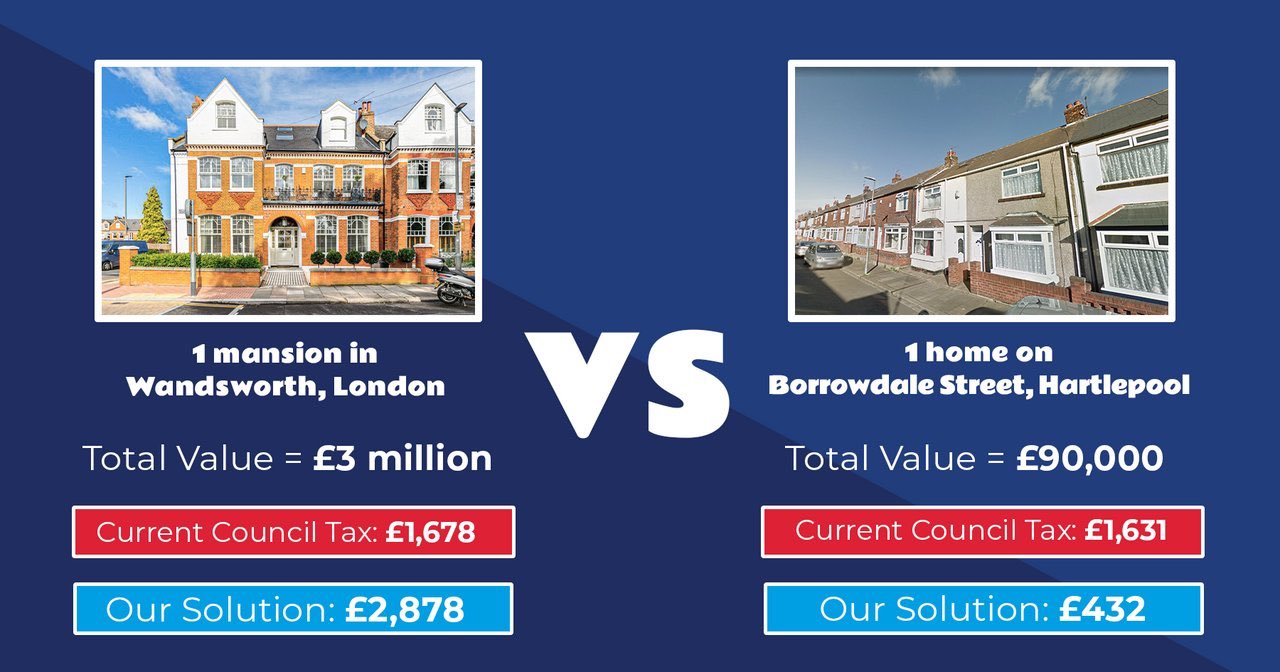

It should come as no surprise to see the extent to which many people are fed up with council tax. It is outdated and highly regressive, both within local areas and between them. Council tax hits the poorest residents of our society hardest while mansions or luxury apartments in Westminster or Kensington barely notice council tax, deeming it less than a service charge.

The worst hit areas are the regions of the United Kingdom once known as Labour’s heartlands, with the North East getting hammered the hardest. Hartlepool, for example, is the worst hit local authority. Residents there pay 1.31% of the value of their homes in council tax, whereas in Westminster, the average resident pays just 0.06% of their property value in council tax. That means the average resident in Hartlepool has a council tax burden 22 times that of Westminster.

Yet to talk about the regional disparities is to underplay the full extent of the problem. Council tax is derived by bands based on 1991 house valuations. The bottom bands pay a larger percentage of property value than the top bands, and houses at the bottom of each band pays significantly more than a property at the top of it.

At Fairer Share, we propose replacing council tax and stamp duty, which has a whole host of problems that hinder economic growth, with a flat property tax of 0.48% of the value of the property.

Flat taxes usually aren’t considered great progressive victories, but that is merely a reflection of the backwardness of the current system (something that shouldn’t be surprising given that portable MP3 players are five years newer than the current council tax regime).

Replacing council tax and stamp duty would be beneficial 76% of households across the UK. There are particular benefits for the poor, nearly 90% of the poorest in society and would add nearly £300 to their average net income per year. Although, facially a neutral policy, it would also have social justice implications, with our analysis showing that large majorities of households in all the UK’s major ethnic minority communities benefiting from a move from council tax to a proportional property tax.

Remarkably, this policy can be achieved without taking a penny out of the treasury’s coffers. The flat rate of 0.48% would return exactly the same revenue as that lost by council tax and by stamp duty, and helping to preserve the vital local services on which we all depend. Raising money for police or social care with regressive precepts could be a thing of the past as local authorities could flex their local rate and raise revenues more fairly from their residents.

Support for the policy is growing in Westminster. Labour’s Grahame Morris is a key supporter, having pushed Boris Johnson on the policy at Prime Minister’s Questions recently. But the policy cuts across party lines, with a number of northern Conservative MPs also supportive.

Across the UK, more than 120,000 households have signed our petition calling for a proportional property tax. A progressive Labour party should also be wholeheartedly backing the introduction of a fairer system of property tax that will deliver in real terms for the majority of voters up and down the country.

Andrew Dixon

Chairman & Founder

Fairer Share

Our Response to Financial Secretary to HM Treasury, the Rt Hon. Jesse Norman

Since launching Fairer Share in the spring of 2020, we have been inspired by the 120,000 households who have signed our petition calling for reform. These have come from all walks of life – young families struggling to get by in the face of rising Council Tax bills, hard-working families in tenanted accommodation, grandparents wondering how their grandchildren will find a way onto the property ladder, the housing industry looking for alternatives to Stamp Duty.

In March we received this letter from Jesse Norman MP who has the important role of Financial Secretary to the Treasury. We have responded to his comments in a Q&A format below. Jesse Norman’s response shows the importance of our work and the need to continue the fight for a fairer property tax system!

Jesse Norman MP ![]()

Thank you for sending the briefing from Fairer Share in January on replacing Council Tax and Stamp Duty Land Tax (SDLT) with a Proportional Property Tax.

The data provided in the briefing by Fairer Share which you forwarded gives a very useful insight into the thinking behind the proposed new package, and any serious proposal that purports to reduce tax for the majority of people and improve economic efficiency while remaining equitable and revenue neutral overall is of obvious potential interest.

Fairer Share ![]()

Thank you. Our data and analysis clearly show that Stamp Duty hinders mobility and Council Tax is increasingly a service charge for the wealthy and a rising wealth tax for low and middle-income households.

Across England around 76% of households would benefit under a proportional property tax, with households paying £435 less property tax a year on average.

There are 78 constituencies where over 99% of households would benefit from moving to a proportional property tax. Many of these are in the north of England and the midlands but there are also plenty of southern seats that would benefit from the change.

We are grateful for the endorsement for a proportional property tax by leading economists in the national media including Martin Wolf at The Financial Times and Russell Lynch at The Daily Telegraph.

In his recent op-ed piece in the Daily Telegraph, Aaron Bell, who took Newcastle-under-Lyme from Labour for the Tories at the 2019 election, said: ‘…abolishing Council Tax and Stamp Duty and replacing them with a fairer property tax is the right thing to do for millions of people up and down the country. It is also the right thing for the Conservative Party to do if we are serious about delivering to those who voted Tory for the first time in a generation.’

Jesse Norman MP ![]()

However, the proposal would involve a radical overhaul in existing tax arrangements, and inevitably this would bring disadvantages as well as advantages. Despite its limitations, the current system has evolved over time. It is familiar, well-understood and factored into people’s planning.

Fairer Share ![]()

Council Tax may well be familiar to the Government and factored into planning. That does not mean it is without harm. As recently noted, by Citizens Advice: “Council Tax is one of the bills that people have been struggling with the most. We estimate that over 3.5 million people are currently behind on Council Tax.”

This is 5% of the population struggling to pay their bills, with families facing debt-collectors and having to face unnecessary pain because of the regressive nature of the tax.

Familiarity and planning are indeed important. A PPT would, in time, also become familiar and very easy to understand due to the simple flat rate of 0.48%. It is much simpler to plan for because those with assets and wealth are able to plan in a way that the poorest in society are not. An argument for inertia on these grounds could be made for all taxes and ignores the harm caused by Council Tax.

Jesse Norman MP ![]()

Thus, as well as expected costs and benefits, any radical change would almost certainly involve unintended consequences, some negative and potentially serious.

Fairer Share ![]()

Of course, no system of property taxation will make everyone happy. But a scenario in which a small number of homeowners have enjoyed a large increase in property value and a much smaller rise in their tax bill is surely preferable to the current system under which many hard-working tenants face 5% annual increases in Council Tax whilst not benefitting from a commensurate increase in property value.

Former Governor of the Bank of England, Mark Carney, in his recent book – “Value(s), Building A Better World for All” – explains that distributional impacts are explicitly taken into account in cost-benefit analysis conducted by the US federal government. This has spawned the doctrine of prioritarianism in which the social goal is to maximise welfare but with priority given to the most disadvantaged. Mark goes on to say, “The allocation (or ‘incidence’) of costs and benefits matters, and even if ‘losers lose more than gainers gain in monetary terms, we cannot exclude the possibility that the losers lose less than the gainers gain in welfare terms.”

Or in other words, an extra £1,000 means less to say Roman Abramovich than £500 does to someone who is struggling to pay their Council Tax bills. Mark explains, “In part, this can be explained by the diminishing utility of money. There is widespread evidence that, above certain thresholds, small additional monetary gains or losses are relatively immaterial from a welfare perspective, whereas for the least well off they are material.”

With a PPT, the 24% of households who will pay more are the asset rich - those lucky enough to live in large houses (£800,000+) in London and the south east. Those lucky enough to have second homes and weekend retreats will pay more. Foreign investors will pay more.

If the Conservative Party is serious about levelling up, not just paying lip service to it, these trade-offs have to be made. Our proposal is not radical and the cap on the increase of £1,200 per year limits any losses to a sensible and politically palatable amount. Proportional Property Tax is a moderate, conservative but progressive, reform with cross-party support and if this is too heavy a lift then I fear this Government may have little to show to its “Blue Wall” when election time arrives in three-years’ time.

Jesse Norman MP ![]()

All these things are matters of potential concern. For the sake of clarity, I set out some more specific thoughts on these issues below.

First of all, the briefing acknowledges that removing Council Tax and SDLT and replacing them with a proportional property tax will raise annual taxes for many households. Even with the proposed cap, it is important to note that this would risk being perceived publicly similarly to a ‘mansion tax’, a significant and unanticipated increase in bills for families and pensioners who have saved and improved their homes.

Fairer Share ![]()

We respectfully but strongly disagree. This is not a tax increase – overall our policy is revenue neutral. We are scrapping both Stamp Duty and Council Tax, replacing both with a fairer proportional system.

Nor is it a wealth tax. On the topic of a proportional property tax, the Daily Telegraph’s Economics Editor Russell Lynch wrote: ‘this is not a “mansion tax” or anything like it.’ Neither is it in keeping with a wealth tax, which is generally understood to be imposed upon an individual’s entire net wealth.

Those living in houses valued at £500,000 or less (90% of all households in England) are likely to see a reduction in their tax bills because the future proportional property tax will be less than their current Council Tax payments.

In no meaningful way is it a mansion tax either. Singapore, hardly a bastion for socialism, has a much more aggressive 4% rate on owner-occupied land. We are asking this government to place the tax on the value on the property, not the land, and to do so at a rate 8 times lower than Singapore.

On home improvements the rate itself negates this problem. With a flat tax of 0.48%, this equates to less than 1/200th of any increased value from home improvements. Such a payment would be much less than the 20% VAT rate charged on materials, so a proportional property tax at 0.48% per year is certainly no more of a disincentive to improve one’s home than VAT, which is charged at 20% and is paid upfront.

Jesse Norman MP ![]()

On the policy design itself, Council Tax is designed, as you will be aware, to help pay for the cost of local services. These services are used by everyone, including those that rent a property, and the fairness of relieving renters from this tax should be considered. There is also an obvious concern that relieving every household that rents its home from paying this tax, and placing the liability on the property owner, would simply lead to landlords increasing rent to compensate for the tax rise. Reliefs and exemptions already exist for those who are struggling to pay a Council Tax bill.

Fairer Share ![]()

Yes, property owners are very likely to pass some or all of the tax down to the tenant through higher rent. This is obvious and expected but it is important to keep in mind that 75% of properties will see a reduction in Council Tax.

Therefore, it is likely that the landlord will pay less property tax than the tenant is currently paying in Council Tax. As a result, the tenant will receive a net gain as future rent (incorporating the proportional property tax) will still be less than the current rent plus Council Tax. This means that the landlord maintains their yield from the property and the renter has lower bills, except in the cases of the extraordinarily wealthy.

Our view is that households are already paying sufficient property taxes – the problem is that the wrong households are paying the wrong taxes at the wrong times. The current inequity exists within individual constituencies, between regions, and between the generations. The 2019 Conservative Party manifesto promised to “redesign the tax system so that it boosts growth, wages and investment and limits arbitrary tax advantages for the wealthiest in society.” Reforming property taxes should be part of the solution.

Jesse Norman MP ![]()

Turning to the proposal to replace SDLT, SDLT has been designed as a proportionate tax, which is paid by people who can afford to purchase a property. Those who can afford to purchase higher value properties pay more, and purchases of additional properties incur higher rates, as will purchases by non-UK residents from 1 April 2021. Furthermore, the Government has relieved first-time buyers who purchase a property of £500,000 or less from paying SDLT on the first £300,000 of the property’s value.

Fairer Share ![]()

Yes, the first-time buyers SDLT discount is indeed helpful but it does nothing to facilitate young families moving up the property ladder nor does it incentivise older generations to downsize to property sizes more appropriate for their life-style. Stamp duty stops families moving because it taxes at the point of transaction, thereby making the housing market less efficient. Helping people move has huge economic and social benefits, a point repeatedly made by yourself and the Chancellor.

Jesse Norman MP ![]()

In 2019-20, residential SDLT raised £8.4bn, which is rather more than the £4.2bn suggested in the briefing.

Fairer Share ![]()

For clarification, the £4.2 billion mentioned in the briefing relates to the lost revenue from primary homeowners. We recommend retaining SDLT for second homes, buy-to-lets and foreign buyers. The net revenue therefore remains the same.

Jesse Norman MP ![]()

Despite the significant revenue raised, 34% of transactions did not involve payment of any SDLT at all because they fell under the starting threshold or a first-time buyer. Any government would need to consider very carefully the impact of replacing such a secure tax.

Fairer Share ![]()

Our policy is revenue-neutral. Revenue from the Proportional Property Tax (£36.7 billion) recoups lost revenue from for the abolition of SDLT for primary homeowners (£4.2 billion), removal of Council Tax (£31.9 billion) and miscellaneous adjustments (£0.6 billion). In addition, HM Treasury (and local authorities) will have flexibility to increase or decrease the tax take in future years by adjusting the 0.48% rate.

Jesse Norman MP ![]()

Finally, in relation to the delivery of a Proportional Property Tax and the necessity for frequent revaluations of properties, I understand your concern about the current system of basing bills on 1991 values. By way of context, it is worth pointing out that a full revaluation of every property in the UK would be expensive to undertake, and many final values reached would be controversial. It would involve a huge upheaval, and would also risks accusations of being unfair or inconsistent as a result of in-year or regional disparities in the property market.

Fairer Share ![]()

At some point the Government will have to undertake revaluation. Using 1991 house values will just entrench and worsen existing inequalities and seem ever more outdated and ridiculous.

The best reason to undertake a valuation is to introduce a better system that brings with it serious political upside by putting cash in the hands of 76% of households. Letting this problem slip into the future is short-termist and will be harmful to the Government and the Conservative Party’s manifesto commitment to level up

We commissioned the well-respected International Property Tax Institute (IPTI) to write a 200-page deep dive into the issue of valuation. Other jurisdictions manage to provide accurate valuations of the capital values of their properties – Netherlands, New Zealand, British Ontario, New York. For a country that prides itself on data analytics and AI your concerns around valuation are insufficient.

In IPTI’s view, the introduction of PPT poses no insurmountable technical or valuation issues. As we have already stated, much of the rest of the world operate similar systems and they have proved reliable and sustainable.

There are implementation costs to be considered but, in comparison with the potential revenue to be derived from PPT, they would appear to provide good value for money in terms of cost/yield ratio. The Government already collects the requisite data at the VOA. To undertake a PPT it is a case of using the data correctly.

The IPTI point out “the biggest problem likely to be encountered in connection with PPT will be at the political level. Experience has shown that many UK politicians and governments have regarded council tax reform as an area to avoid but, in IPTI’s view, the present system does not operate as effectively or as equitably as many other property tax systems around the world, so there are sound arguments in favour of reform.”

Jesse Norman MP ![]()

For these reasons, the Government has no plans to introduce a Proportional Property Tax. But despite these concerns, I and my colleagues in the Treasury remain interested in the work of the PPT campaign, and I am very grateful to Fairer Share and to you for sharing this proposal. As you know, the Government keeps all aspects of the tax system under review, and we warmly welcome serious and constructive contributions from outside organisations and campaigning groups.

Fairer Share ![]()

That is a pity. Council tax is clearly broken. Everybody in government knows this.

In today’s Financial Times, the editorial board wrote “Taxation of property is incoherent, notably in the UK: the regressive burden of council tax is proportionately much higher for owners of cheaper properties than more expensive ones. Moreover, valuations have not been updated for England since 1991. Reform is urgent: this should consist of a tax proportional to the property value, regularly updated valuations and the capitalisation of the tax for elderly residents, with the balance paid out of the estate.” As you know, Fairer Share has incorporated all three recommendations – proportionality, regular valuations and capitalisation.

The remarkable thing is that no one has managed to find a way yet to reform it, while the tax continues to hit our poorest residents hardest, pushing them into poverty and making it harder for councils to raise funds for critical local services.

Despite unemployment surging due to coronavirus, a majority of councils are preparing to bump bills up by an unprecedented 5%, inflicting maximum pain on millions of already hard-pressed households.

Our solution is very similar to that put forward by leading thank tanks such as Institute for Fiscal Studies, IEA, IPPR, Resolution Foundation, Onward, Centre for Policy Studies. We have combined the best features of each. This sustainable and progressive policy benefits the exact voters your party so desperately wishes to support.

By sitting on the sidelines of this debate, recognising that there are problems with Stamp Duty and Council Tax but not offering up a convincing alternative, you are allowing individuals and families to fall into debt that you know is unnecessary and unfair. And you are forcing councils to hit their own poorest residents in order to maintain their budgets.

The arguments in your letter to Kevin Hollinrake MP are, in our view, flimsy and insufficient to negate the obvious benefits of our solution. They are, perhaps, reflective of the Government’s inertia when it comes to actually carrying out the work of levelling up. My personal fear is that because your party is doing so well in the polls you will do the bare minimum to level up.

We hope that you will reconsider your position in light of our responses.

Andrew Dixon

Chairman & Founder

Fairer Share

Killing off Council Tax could be key to Labour or Tories winning in local elections

Labour or the Conservatives could triumph in next month’s local elections by pledging to overhaul council tax, new polling indicates.

With households across the UK still reeling from the latest council tax hikes, the nationwide polling suggests that millions of votes are potentially up for grabs on 6th May. It found that:

> Four out of ten people (40%) across the UK would consider switching their vote to a party backing a fairer property tax system with lower bills for most people and local services maintained at the same level.

> In the ‘red wall’, almost five out of ten people (49%) would consider switching their vote on this basis.

As politicians hit the campaign trail, the polling makes clear that people are more likely to vote on ‘kitchen table’ issues than ‘culture war’ issues:

> Across the UK, 76% of people chose either council tax, investment in local services, supporting local shops or local transport improvements as the issue that would most influence their vote in the local elections. Just 7% of people chose seeing the Union Jack flown on local public buildings as influential.

> In the ‘red wall’, 80% of people chose council tax, investment in local services, supporting local shops or local transport improvements. Nobody chose seeing the Union Jack flown on local public buildings.

Action on council tax could have a major impact on next month’s local elections as a number of tightly contested councils are home to people who get an especially bad deal on council tax. These include Hartlepool, Burnley and Pendle where there is no party in overall control and where voters must pay out a high proportion of their home’s value in council tax every year.

Labour and the Conservatives have also been advised that adopting a position on killing off council tax could swing the Hartlepool by-election.

As a parliamentary constituency, Hartlepool gets a worse deal than almost anywhere else in the country on council tax. Meanwhile the polling suggests that in the north east, more than five out of ten people (51%) would consider switching their vote to a party backing a fairer property tax system.

Andrew Dixon, chair of Fairer Share, said:

“Voters know that council tax is not fit for purpose. We urgently need a fairer system such as a simple proportional property tax that would lower bills for 76% of households across the country.

“Instead of a political tit-for-tat where council tax rises are inevitably blamed on the local party in power, our politicians should seize the initiative and make a proposition that voters can’t refuse.

“We can see that whichever party steps up on council tax reform will see a massive dividend in the local elections. All of the signs are that killing off council tax could also be the secret weapon that will help Labour or the Conservatives to win the Hartlepool by-election.”

Currently, the North East Party is the only party in the Hartlepool by-election actively campaigning to reform council tax.

Hilton Dawson, former Labour MP and North East Party candidate for Hartlepool, said:

“Boris Johnson’s government talk of levelling up the north. However, so far, despite some pressure from some Conservative & Labour MPs they have failed to consider a big idea which could change everything.

“Scrapping council tax and charging each homeowner 0.48% of the value of their property would raise the same amount for public services as the current system. A fair property tax to replace council tax would also bring huge beneficial change to Hartlepool. Everyone in Hartlepool would benefit.”

To join our campaign to #TaxHomesFairly, visit: https://fairershare.org.uk/petition/

Council tax works for millionaires and not for the millions

This article first appeared in the Metro on April 5th 2021, written by our founder, Andrew Dixon.

When voters go to the polls in the local elections next month, many will do so in the wake of their council tax bills rising up like never before.

Despite unemployment surging due to coronavirus, a majority of councils are preparing to bump bills up by an unprecedented 5%, inflicting maximum pain on millions of already hard-pressed households.

So why are our leading politicians not going into the local elections with a viable plan to turn the situation around?

As our primary residential property tax, council tax is clearly not fit for purpose. It is based on property valuations from 30 years ago, dating back to just before Nirvana released their breakthrough album Nevermind and Tim Berners-Lee released files describing his idea for the World Wide Web.

It is a terrible, regressive tax that hits renters saving up for a deposit just as hard as those who have made it onto the property ladder. Council tax also ensures that people who live in more modest houses and areas end up paying a higher tax rate than those living in wealthier areas and more valuable properties.

The Fairer Share campaign that I chair recently heard from a lady in Birmingham who works four cleaning jobs. She and her husband live in a three-bed semi-detached house. They pay £129 a month in council tax and struggle with the costs.

We have also heard from a retired Army officer in the north east. After his divorce, he couldn’t afford to move into a house so he lives in a private caravan site with minimal public services. He still pays £92 a month in council tax.

Another of our northern supporters currently pays £2,328 a year for a band D property, which is valued at around £180,000. Meanwhile, on Zoopla she can see a band H £9.8million six-bedroom detached house in London pays just £1,560 each year in council tax.

For any politician going into the local elections, there are surely votes to be won from backing reform of this ridiculously unfair tax. Yet too many politicians are sitting on the sidelines of the debate, hitting out at council tax rises without offering up a convincing alternative source of revenue for cash-strapped local authorities.

"Across England around 76% of households would benefit under a proportional property tax, with households paying £435 less property tax a year on average."

In much of the country, it is a different story. More than 115,000 people have signed the Fairer Share petition calling for council tax and stamp duty to be replaced with a simple proportional property tax set at a flat rate of 0.48% of a property’s value.

There are also growing signs of support in the House of Commons. A number of MPs from both parties are now backing the plan, with our research showing that the tax generated would maintain the amount that the Government can put towards our services – while simultaneously leading to lower bills for millions of people.

Across England around 76% of households would benefit under a proportional property tax, with households paying £435 less property tax a year on average.

There are 78 constituencies where over 99% of households would benefit from moving to a proportional property tax. Many of these are in the north of England and the midlands but there are also plenty of southern seats that would benefit from the change.

While renters would pay nothing, some homeowners in London may see a small increase in their annual bills, reflecting the extreme rise in house prices over the past 30 years.

However, we know that it would be unfair to create ‘losers’ on day one of the policy being implemented. Instead, our campaign is proposing a cap on the increases in tax of £100 per month, not far off the price of a daily cup of coffee.

If our politicians are not brave enough to introduce a proportional property tax then the alternative is sticking with the current broken system.

Andrew Dixon

Chairman & Founder

Fairer Share

The 10 Areas with the Highest Council Tax Burden

We often see news articles outlining the areas that pay the highest Council Tax. However, these stories only look at the total Council Tax figure, not the figure relative to a household's ability to pay. To provide a better perspective we have researched the constituencies with the highest Council Tax Burden (Council Tax as a % of property value).

Here are the 10 Constituencies with the highest Council Tax Burden:

1) Easington | Council Tax Burden = 1.41% of the average property value

Region: North East

Political Party: Labour | Member of Parliament: Grahame Morris MP

Average Council Tax: £1,250

Proportional Property Tax (PPT) saving: £900 Households better off (under PPT): 100%

Levelling Up Index: 10 (10 = most in need, 1 = least in need)

2) Hartlepool | Council Tax Burden = 1.31%

Region: North East

Political Party: Conservative | Member of Parliament: Jill Mortimer MP

Average Council Tax: £1,450

Proportional Property Tax saving: £950 Households better off: 100%

Levelling Up Index: 10

3) Burnley | Council Tax Burden = 1.28%

Region: North West

Political Party: Conservative | Member of Parliament: Antony Higginbotham MP

Average Council Tax: £1,300

Proportional Property Tax saving: £850 | Households better off: 100%

Levelling Up Index: 10

4) Middlesbrough | Council Tax Burden = 1.27%

Region: North East

Political Party: Labour | Member of Parliament: Andy McDonald MP

Average Council Tax: £1,300

Proportional Property Tax saving: £850 | Households better off: 100%

Levelling Up Index: 10

5) Liverpool Walton | Council Tax Burden = 1.23%

Region: North West

Political Party: Labour | Member of Parliament: Dan Carden MP

Average Council Tax: £1,150

Proportional Property Tax saving: £800 | Households better off: 100%

Levelling Up Index: 10

6) Preston | Council Tax Burden = 1.21%

Region: North West

Political Party: Labour | Member of Parliament: Sir Mark Hendrick MP

Average Council Tax: £1,250

Proportional Property Tax saving: £850 | Households better off: 100%

Levelling Up Index: 10

7) Blackpool South | Council Tax Burden = 1.20%

Region: North West

Political Party: Conservative | Member of Parliament: Scott Benton MP

Average Council Tax: £1,250

Proportional Property Tax saving: £750 | Households better off: 100%

Levelling Up Index: 10

8) Redcar | Council Tax Burden = 1.20%

Region: North East

Political Party: Conservative | Member of Parliament: Jacob Young MP

Average Council Tax: £1,350

Proportional Property Tax saving: £900 | Households better off: 100%

Levelling Up Index: 10

9) North Durham | Council Tax Burden = 1.19%

Region: North East

Political Party: Labour | Member of Parliament: Kevan Jones MP

Average Council Tax: £1,350

Proportional Property Tax saving: £850 | Households better off: 100%

Levelling Up Index: 9

10) Nottingham North | Council Tax Burden = 1.17%

Region: East Midlands

Political Party: Labour | Member of Parliament: Alex Norris MP

Average Council Tax: £1,150

Proportional Property Tax saving: £800 | Households better off: 100%

Levelling Up Index: 10

To see the data for all English Parliamentary constituencies, click here for Council Tax Burden and here for the impact of our reforms.

Letter to Fairer Share from Financial Secretary to HM Treasury, Rt Hon. Jesse Norman MP

In March we received the following letter from Jesse Norman MP who has the important role of Financial Secretary to the Treasury. The letter outlines the Government's view of our campaign. To see our response to the points raised in the letter, click here.

Dear Kevin,

Thank you for sending the briefing from Fairer Share in January on replacing Council Tax and Stamp Duty Land Tax (SDLT) with a Proportional Property Tax. As I said when we spoke, I thought it would be helpful to send you a written response to the proposal.

The data provided in the briefing by Fairer Share which you forwarded gives a very useful insight into the thinking behind the proposed new package, and any serious proposal that purports to reduce tax for the majority of people and improve economic efficiency while remaining equitable and revenue neutral overall is of obvious potential interest.

However, the proposal would involve a radical overhaul in existing tax arrangements, and inevitably this would bring disadvantages as well as advantages. Despite its limitations, the current system has evolved over time. It is familiar, well-understood and factored into people’s planning. Thus, as well as expected costs and benefits, any radical change would almost certainly involve unintended consequences, some negative and potentially serious.

All these things are matters of potential concern. For the sake of clarity, I set out some more specific thoughts on these issues below.

First of all, the briefing acknowledges that removing Council Tax and SDLT and replacing them with a proportional property tax will raise annual taxes for many households. Even with the proposed cap, it is important to note that this would risk being perceived publicly similarly to a ‘mansion tax’, a significant and unanticipated increase in bills for families and pensioners who have saved and improved their homes.

On the policy design itself, Council Tax is designed, as you will be aware, to help pay for the cost of local services. These services are used by everyone, including those that rent a property, and the fairness of relieving renters from this tax should be considered. There is also an obvious concern that relieving every household that rents its home from paying this tax, and placing the liability on the property owner, would simply lead to landlords increasing rent to compensate for the tax rise. Reliefs and exemptions already exist for those who are struggling to pay a Council Tax bill.

Turning to the proposal to replace SDLT, SDLT has been designed as a proportionate tax, which is paid by people who can afford to purchase a property. Those who can afford to

purchase higher value properties pay more, and purchases of additional properties incur higher rates, as will purchases by non-UK residents from 1 April 2021. Furthermore, the Government has relieved first-time buyers who purchase a property of £500,000 or less from paying SDLT on the first £300,000 of the property’s value.

In 2019-20, residential SDLT raised £8.4bn, which is rather more than the £4.2bn suggested in the briefing. Despite the significant revenue raised, 34% of transactions did not involve payment of any SDLT at all because they fell under the starting threshold or a first-time buyer. Any government would need to consider very carefully the impact of replacing such a secure tax.

Finally, in relation to the delivery of a Proportional Property Tax and the necessity for frequent revaluations of properties, I understand your concern about the current system of basing bills on 1991 values. By way of context, it is worth pointing out that a full revaluation of every property in the UK would be expensive to undertake, and many final values reached would be controversial. It would involve a huge upheaval, and would also risks accusations of being unfair or inconsistent as a result of in-year or regional disparities in the property market.

For these reasons, the Government has no plans to introduce a Proportional Property Tax. But despite these concerns, I and my colleagues in the Treasury remain interested in the work of the PPT campaign, and I am very grateful to Fairer Share and to you for sharing this proposal. As you know, the Government keeps all aspects of the tax system under review, and we warmly welcome serious and constructive contributions from outside organisations and campaigning groups.

As ever,

RT HON JESSE NORMAN MP

Campaigners from across the political divide unite to call for overhaul of residential property taxes

Below is an open letter to the Chancellor of the Exchequer published on 14th March 2021, featuring in The Observer.

Dear Chancellor,

We are writing to ask you to consider announcing a root and branch review into the way residential property is taxed in the UK.

As the Government begins to plot its way out of the coronavirus pandemic, which has accentuated the inequalities in our society, fairness should be at the heart of the Government’s policy agenda. This must mean looking at the options for reforming our residential property taxes so that they are based on today’s property values and homeowners’ ability to pay, while encouraging efficient use of our housing stock and generating incentives for local communities to accommodate development.

Any such review should begin by focusing on Council Tax, which is poorly designed, out of date, and unpopular. This tax is based, in England and Scotland, on property valuations that are now almost 30 years old and therefore bear no resemblance to the realities of current house prices.

It would appear that Council Tax is a material wealth tax for those in modest houses but is a modest service charge for those in wealthier areas. This places the heaviest burden on the young, low-earners, and those living in less prosperous parts of the country, who typically reside in modest properties.

We have known for many years that Council Tax is not fit for purpose but the situation is now critical. Council Tax is increasingly putting lower-income families into debt and Covid-19 has only exacerbated the situation, with an extra £700 million added in outstanding Council Tax debt from over 800,000 UK households between March and September alone.

A review of property taxes should also consider whether there is a place for Stamp Duty in a modern system of property taxation. By taxing property transactions, Stamp Duty discourages homeowners from moving and blocks up the property market, hindering older people from downsizing and limiting young families’ ability to move up the property ladder. This has wider dynamic economic implications as we have seen from the Stamp Duty holiday.

Households are already paying comparable property taxes relative to other developed nations – the problem is that the wrong households are paying the wrong taxes at the wrong times. The current unfairness exists within individual constituencies, between regions, and between the generations.

We urge you to use the so-called “Tax Day” on 23 March, when the Treasury will publish a range of consultations and calls for evidence into tax policy, to begin this review process. We are ready and willing to support the Government with its efforts to introduce a fairer and more efficient system of property taxation that is fit for the modern age. We recommend the Government examines this issue through the lens of fairness, economic activity, social mobility, housing stock efficiency, the Government’s levelling up agenda and the impact of the pandemic on household and local government finances.

We look forward to your response and to the upcoming consultation announcements.

Kind regards,

Alicia Kennedy, Director, Generation Rent

Andrew Dixon, Chairman, Fairer Share

Anya Martin, Director, Priced Out

Ben Rich, CEO, Radix

Carys Roberts, Executive Director, IPPR

Charlotte Alldritt, Director, Centre for Progressive Policy

Dr Gavin Kerr, author of “The Property-Owning Democracy: Freedom & Capitalism in the 21st Century”

Dr Justin Thacker, Director, Church Action for Tax Justice

James Kirkup, Director, Social Markets Foundation

John Muellbauer, Institute for New Economic Thinking, Oxford Martin School

John Myers, Founder, London YIMBY

Liz Emerson, Co-founder, Intergenerational Foundation

Neal Lawson, Director, Compass

Polly Mackenzie, Chief Executive, Demos

Professor Philip Booth, Director of the Vinson Centre for the Public Understanding of Economics and Entrepreneurship, University of Buckingham

Robert Colvile, Director, Centre for Policy Studies

Robert Palmer, Executive Director, Tax Justice UK

Robin McAlpine, Director, Common Weal

Ryan Shorthouse, Chief Executive, Bright Blue

Sam Dumitriu, Research Director, The Entrepreneurs Network

Torrin Wilkins, Director, Centre Think Tank