We all pay Council Tax. But just how much do we really know about one of our largest monthly expenses? Let’s find out! We have compiled 12 things you might not know…

#1 – A house worth £100,000 pays 6 times more relative to its value than a £1 million property

This is like paying 6 times the VAT on a Ford Focus than on a Ferrari…

#2 – Some households would pay the FULL VALUE of their property in Council Tax payments in just 20 years

Have to read that twice? So did we! Certain properties in Easington Colliery, County Durham, pay up to 5% of their value each year in Council Tax. After just 20 years of Council Tax payments, these households will have spent the same amount on Council Tax as their house value!

In comparison, if you’re lucky enough to own a £10 million property in Westminster, it would take 6,410 years of Council Tax payments to match your property value, and those living in more expensive homes it takes even longer! It’s just not right.

#3 – 3.5 million households are estimated to be in Council Tax arrears

Even before the pandemic, around 2.1 million households were in Council Tax debt. Between March and May, an estimated 1.3 million additional households had fallen behind on Council Tax, bringing the total to an outrageous 3.5 million British homes in Council Tax debt. This is not sustainable.

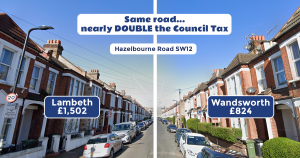

#4 – Houses on one side of the same road can pay £500 more than those on the other side

Our favourite fact. Nothing quite demonstrates how nonsensical Council Tax can be quite like a row of houses in Lambeth paying over £500 every year more than properties on the other side of the same street in Wandsworth. These properties really should be paying exactly the same or at least something similar. It’s just not fair.

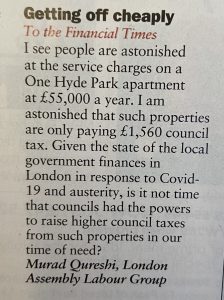

#5 – The richest are not always paying their fair share

We regularly see articles of billionaires moving their money to Monaco, Bermuda or the Cayman Islands to avoid paying income or corporation tax.

On top of this, tax bands do not reflect the value of mansions. As a result, we see £150 million properties in Kensington like this where the Council Tax is effectively capped under £2,474 per year.

We should all pay our fair share and property taxes should not be avoided by using clever loopholes.

#6 -Second homes, empty homes, and holiday homes receive exemption

Second homes and empty homes are eligible for a discount of up to 50% on their Council Tax bill. The Daily Telegraph even ran an article last year titled “How to pay no Council Tax on your second home”.

#7 – Areas with the cheapest Council Tax often receive the most in public funding

Often the regions with the cheapest Council Tax receive greater public funding than others. While many areas of London are amongst the cheapest for Council Tax despite high-value housing, more has been spent on funding London’s Crossrail between 2016-2021 (£4.6 billion), than has been spent on all transport projects in all of the North of England (£4.3 billion).

For three decades, properties in London and the South East have benefitted from this unfair system. These regional imbalances must be addressed.

#8 – Council Tax bands haven’t been updated for 30 years

In that time, average property prices in London have risen from £76,000 to £490,000, while prices in the North East have only risen from £42,000 to £132,000. As a result, the top four cheapest areas for Council Tax are Westminster, Wandsworth, the City of London, and Hammersmith. The more house prices rise in a region, the more out of date Council Tax bands become.

Wales did manage to update their bands in 2005, showing it is possible to analyse valuations with political will.

#9 – It’s complicated

Over half the population (52%) said they had no understanding of how Council Tax works. The system should be easy to understand.

#10 – Less than 30% of the public think Council Tax is fair and 67% believe it should have more of a link to actual property value

Our research found that less than 30% of the British public think the tax is charged fairly across the country. Tax Justice UK also found that 67% of the public (including a majority of Conservative voters) support reforming Council Tax so it was more closely tied to the property’s value.

#11 – Council Tax has come to resemble to the dreaded Poll Tax

When the Poll Tax was introduced, the average bill per individual in today’s money was around £790. If we assume two adults per household this would mean £1,580 per household. In 2020, the average band D property now pays more than that in Council Tax – £1,820

#12 – Over 110,000 households have now signed the Fairer Share petition calling on Council Tax to be replaced with a fairer system

We live in critical times: income inequality in Britain is at its worst for a decade, regional inequality is out of control, and millions of people are left using food banks just to get by. Across the UK, there are now more food banks than there are McDonald’s! On top of that, with Covid-19 leading the UK into recession and more families across the country struggling to get by, there has never been a better time to reform our outdated system of Council Tax.

So far, over 110,000 households have signed the Fairer Share petition to replace Council Tax and Stamp Duty with The Proportional Property Tax, a flat rate of 0.48% on the value of property. This would reduce annual property tax bills for 18 million households – 75% of the country.

Join the growing movement of people who want a fairer deal. Add your voice and sign the petition here.