Replacing Council Tax and Stamp Duty with a Proportional Property Tax would raise as much as £4.5 billion from foreign homeowners, empty homes and second homes.

This was the finding from our new report released this week, assessing the impact of international investors on the UK property market, and how property tax reform could help our economy in the future.

Introducing such a Proportional Property Tax, levied on the existing value of peoples’ homes rather than 1991 values (as is the current practice), would lead to 76% of households being better off, with an average saving of £435 per year.

Currently, foreign buyers in Westminster, for example, only pay a maximum of £1,655 a year. The much-needed reform of property taxes would see a surcharge of 0.96% levied on all foreign owned, second and empty homes. This would mean that an international buyer purchasing a £6.2m house in Westminster would pay £59,520 each year in local tax.

Council Tax is deeply regressive with those in low value homes paying more in proportion to the price of their home than those in high value homes. For example, in the Durham constituency of Easington, a family living in a home worth £100,000, presently pays over 1.4% of their home’s value in Council Tax every year. This rate is 52 times higher than the 0.03% rate which the £6.2m home mentioned above in Westminster would pay.

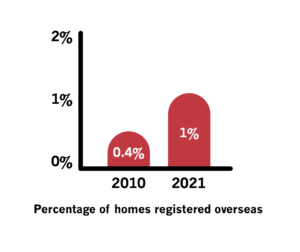

Whilst London remains the prime market for foreign investors, recent data shows that since 2010, overseas ownership has tripled to 250,000 homes across England and Wales, pricing out local households out of the market.

The report reveals that the policy’s surcharge would bring in as much as £4.5 billion in tax revenue, reduce bills for 76% of households and would also free up as many as 600,000 homes over 5 years, including a quarter of a million homes for 1st time buyers.

Calls for replacing Council Tax are set to grow louder this year as the cost of living crisis intensifies. Our polling carried out last year highlighted how Council Tax was the most disliked tax in the country with over 50% saying it was worse than Income Tax, Inheritance Tax and Capital Gains Tax.

The latest findings put further pressure on ministers to bring in a Proportional Property Tax, which has the support of a number of Labour and Conservative MPs, think tanks and the CLG Select Committee.

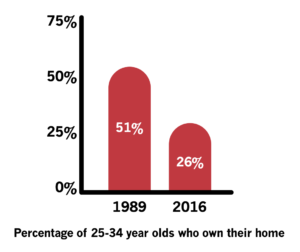

- John Stevenson MP for Carlisle, stated, “If we are to fix the housing market so that more young people can have a home of their own, then ministers should give serious consideration to taxing the high numbers of foreign investors in the UK. The best way of achieving this could be through a Proportional Property Tax, freeing up homes up and down the country.

- Lord David Willetts a former Conservative Minister, has previously said, “We’ve got to help young people get started on the housing ladder, and [a Proportional Property Tax] would bring more houses onto the market and would mean that people in low-value houses will not be paying so much tax”.

- Andy Burnham, the Mayor of Greater Manchester, also argued for replacing Council Tax with a new levy based on the value of your property, stating “The party can’t tiptoe around it anymore”.

- The CLG select committee published a report in July last year recommending the introduction of a PPT, stating, “Council Tax is also an increasingly regressive tax that again penalises those in more deprived areas. A revaluation is long overdue”.

Reflecting on the report, our Founder, Andrew Dixon said:

“The Government is under increasing pressure to get to grips with the housing crisis and ensure foreign homeowners pay their fair share of property tax. Adopting a Proportional Property Tax would mean lower bills for the majority of households in the UK while the surcharge on these purchases would lead to hundreds of thousands of homes coming onto the market for UK residents.”