We’re back in lockdown. Not the outcome that anyone was hoping for, but it is where we are and collectively, we have to make the best of it. Increases in Britain’s inequality and poverty levels have been sent into overdrive since the pandemic began, risking a national household debt crisis. Replacing Council Tax with a fair and equitable system must be high on the Government’s list of priorities over the winter…

Britain, we have a problem

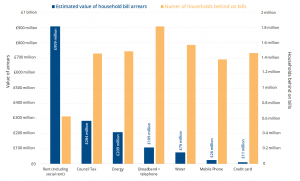

Citizens Advice estimate that over 6 million homes have fallen into debt on at least one of their household bills since the outbreak of Covid-19. A whopping 2.8 million of these homes are in arrears on their Council Tax payments. Of those in debt, 18% have been unable to afford essential items such as food, 30% have run down their savings in order to make ends meet, and 22% are having to sell possessions.

Key workers are feeling the squeeze

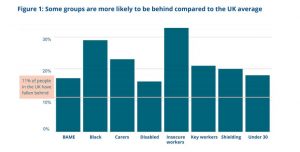

It is especially concerning that 21% of key workers have fallen behind on their bills compared to 11% of the general population.

Source: Citizens Advice (2020)

Source: Citizens Advice (2020)

Of those who have seen a reduction in their income during the pandemic, almost half (46%) have then fallen into debt. If this trend continues through the winter, the damage felt won’t just be to households across the country. Local businesses, local authority finances and our communities themselves will also suffer.

A roadmap to recovery

Council Tax debt isn’t just a short-term problem. With monthly bills continually charged, even to those in debt, the question becomes: how do you get out of it? 40% of those who speak to Citizens Advice currently have a negative budget. This means that after their regular monthly living expenditures, they have nothing left over. The average negative budget is £133. Furthermore, the average monthly surplus was only £82. This is all that is left over for debt repayments each month.

For millions of households, the recovery from the financial shock of the first wave of Covid-19 will be a long one. It is estimated that if those in debt spent their entire disposable income solely on their debt repayments, it would take over two years to repay their “priority” debts – debts that carry the most serious consequences if left unpaid.

Lockdown 2: We can turn this around

The figures above are from the first national lockdown — March to May. Now that we find ourselves plunged into a second iteration of lockdown, these figures are likely to get a whole lot worse. Not only will millions more homes be plunged into Council Tax debt, but those already in arrears will see their debt mount even further. But it doesn’t have to be this way…

A fairer solution

At Fairer Share, our sole aim is to fix the UK’s unfair property tax system. This means replacing the broken Council Tax with what we are calling: The Proportional Property Tax – a flat rate of 0.48% charged on the value of a property.

Of the major debts listed above, Council Tax is by far the simplest to reduce. Operated entirely by public institutions and with no private sector to consider, replacing Council Tax would be far easier than reducing rent or energy debts.

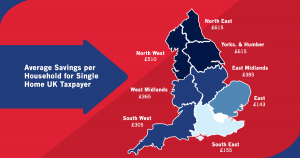

Not only does our proposal reduce tax bills for 18 million households, it also helps those most in need. Of the top 5 most income-deprived areas of the country, the average household saving under our plan ranges from £533 to £819 each year. This won’t suddenly fix the UK’s household debt problem, but it will help to keep millions of families out of Council Tax debt and able to afford essential items such as food.

Furthermore, our proposal includes a deferral mechanism for those unable to pay. The 2.8 million households who have entered into Council Tax arrears since March won’t have to pay it back until they can afford it, or until the sale of their house.

Council Tax will no longer be a priority debt for those unable to pay. Not only will this greatly reduce the stresses of a potential bailiff visit, it allows households already in debt to start paying back their other important debts.

This deferral mechanism relies on removing 8 million renters from the property tax system. Renters have been one of the groups hardest hit by the pandemic, with many living paycheck-to-paycheck and over 320,000 are already in debt to their landlords. They need our support urgently.

We can help reduce the debt crisis, but we need your help!

You can support our campaign by joining the almost 70,000 households who have signed our petition for a fairer system.

You can also Email your MP to let them know why we need to replace Council Tax so urgently.