This article first appeared in Conservative Progress on the 30th August and was written by Tom Spencer, Chair of City Conservative Society.

Our system of council tax is a mess! Based upon estimates of property value conducted in 1991 it acts as a deeply regressive system whereby the richest pay just three times more than the very poorest, despite their incomes being eight times more.

This is particularly damaging for some of the poorest regions in the UK, this is because house prices tend to be higher to wealthier areas. Indeed, official estimates claim that the average house in London is six times what it was in 1995; this is compared to just three times as much in the North East. Thus, the very wealthiest in the very wealthiest areas are paying an insufficient amount of tax when compared to the very poorest in the very poorest areas.

Council tax is one of those taxes which gets extraordinarily little attention given to it, however, for the average household it makes up 3% of their annual income.

Furthermore, as of March 2019 the total council tax debt amounted to £3.2 Billion, a 20% rise over the past 4 years. Therefore, it is a huge burden on ordinary families up and down the country, and deserves to have more scrutiny given to it. This is particularly important when considered in relation to the Governments levelling up agenda. Those towns who incidentally happen to be paying too much council tax, also happen to be towns who the Government so desperately need to keep if they are to keep the old Red Wall from returning to Labour.

We can illustrate this problem with a concrete example: a modest home in Middlesbrough valued at £150,000 will pay £1,702 in council tax. Whereas an £8,000,000 home in Westminster will pay just £1,560 in council tax. This means the former is paying 1% of their house value in tax, and the latter is paying just 0.02%.

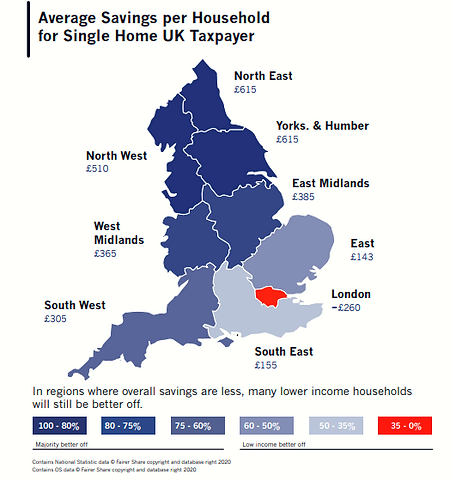

Indeed, the map to the right shows this perfectly. This shows where the impacts would be most impactful of a mere revaluation of council taxes. It reveals that the Northern seats that the Tories won in 2019 would be the biggest beneficiaries of such a scheme.

However, even if a pure revaluation of Council Taxes was done this would not suffice to fix the system. It would still be the case that Band H houses would be paying vastly too little and Band A houses would be paying vastly too much.

Thus, what is needed is not simply reforming the current system, but a complete remodel of how we fund local government. The best idea to address this is proportional property taxes. This view is best advocated by the team at Fairer Share.

What they propose is a flat council tax placed at 0.48%. This would be sufficient to completely remove the need for council taxes and stamp duty land tax – an equally problematic tax that helps further the housing crisis by disincentive moving house and disincentives downsizing, as I argued previously. As well as the obvious benefits this brings by removing two bad taxes, it also presents many benefits in itself.

Firstly, it is extraordinarily simple. A huge benefit of flat taxes is the administration costs become exceptionally low, and avoidance becomes next to impossible. Secondly, the cost savings for average families are truly remarkable. If their plan was implemented in full: 18 million households would pay less tax, 75% of households would be better off, 8.7 million households wouldn’t have to pay any council tax whatsoever and over 750,000 buyers would no longer have to pay stamp duty.

This plan would also do a lot to help address Britain’s rampant inequality. This is particularly important as Britain is the most regionally unequal country in the industrialised world. This tax would see the most deprived regions substantially better off to a greater extent than a mere revaluation would present. This includes annual household savings in excess of £600 for some of the countries most deprived areas in the North East, as illustrated by the map on the left.

To summarise, a proportional property tax represents a much-needed shakeup to local government funding. It would create a more simple system, as well as a more progressive one that will create huge savings for the people who need them most. This will do a huge amount to support the levelling up agenda of the government, as well as help to show that Conservative governments are about more than just delivering Brexit; they’re about delivering sensible reform that will help the people of Great Britain.

Tom Spencer, Chair of City Conservative Society